On January 13th, the crypto market witnessed another wave of selling pressure as Bitcoin teased a breakdown below $90,000. The extended correction is significantly influencing most major altcoins including ETH. The falling Ethereum is at a $3,000 crossroads as increased whale activity could influence a reversal or downfall.

According to Coinmarketcap, Ethereum’s market capitalization is at $365.5 Billion, while the 24-hour trading volume is at $32 Billion.

Key Highlights:

- Ethereum price breakdown below the $3,150 neckline support hints at an extended correction ahead.

- The Ethereum price could plunge another 14% before testing a major support trendline at $3,120.

- An active accumulation trend by crypto whale signals buy-the-dip sentiment intact in crypto investors.

Institutional Investors Bet Big on Ethereum as Market Dips

Recent on-chain activity has highlighted significant Ethereum coin purchases by whales and institutional investors, signaling confidence despite the recent market downturn.

One notable transaction reported by EmberCN reveals a whale spent $26.23 million DAI to purchase 7,983.8 ETH at an average price of $3,286.

一个鲸鱼/机构 6 小时前在链上花费 2623 万 DAI 购买了 7,983.8 ETH,均价 $3,286。

将 DAI 买成 ETH 地址:https://t.co/S1jzrz3cq5

ETH 存放地址:

0x48ec5717a5a5655201e9fd75882b6f03463b2ae4

0xb9f332ab5342edd6c94697acf37d8b4e845d83a7本文由 #Bitget|@Bitget_zh 赞助 pic.twitter.com/9JT6aG5smm

— 余烬 (@EmberCN) January 12, 2025

Another update from EmberCN reported that a whale dubbed “Band Brother” recently acquired an additional 5,672.9 ETH worth $17.35M. This purchase completed a broader strategy, converting a total of $54.65M USDT into 17,125.6 ETH at an average price of $3,191.

波段老哥在半小时前加仓了 1,958.3 ETH ($6.3M)。

他在 10 号凌晨平空转多后,现在已经累计花费 2549 万 USDT 购买了 7792.3 ETH,均价为 $3,271。

他手上还有 2916 万 USDT,可能会继续购买。https://t.co/hEo8JA7EWXhttps://t.co/iuHlmELS1Q

本文由 #Bitget|@Bitget_zh 赞助 https://t.co/dYEUAeREEJ pic.twitter.com/3LUVWcVH0q

— 余烬 (@EmberCN) January 13, 2025

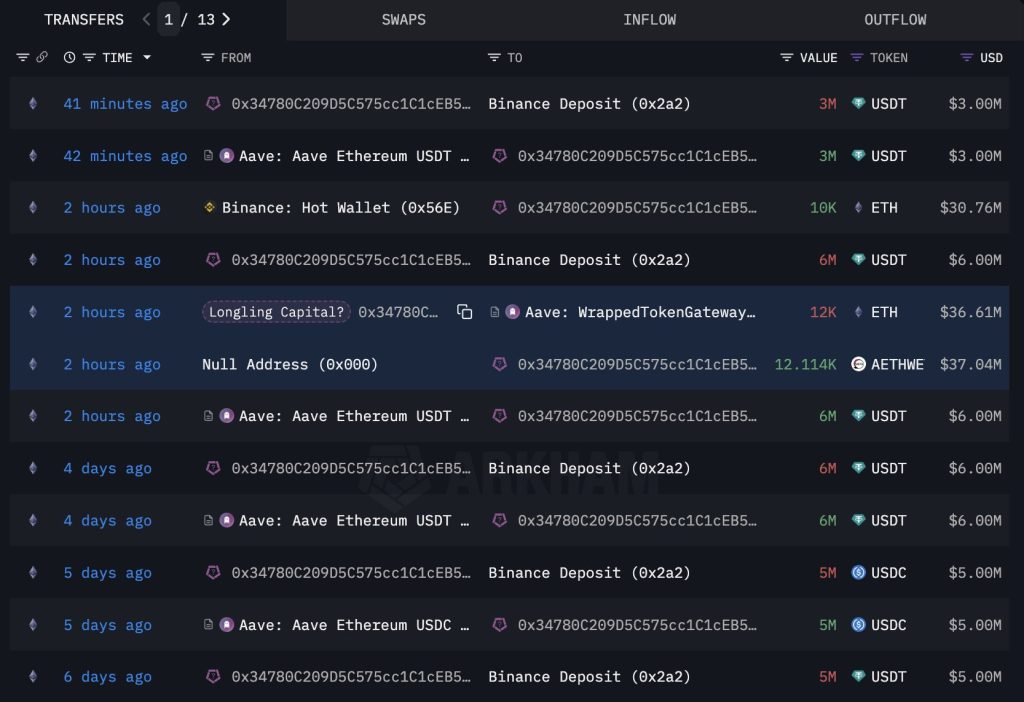

Furthermore, the onchain data from Lookonchain emphasizes the activity of a wallet linked to Longling Capital, which withdrew 10,000 ETH (valued at $30.76M) from Binance. The wallet also borrowed $9 million USDT from Aave and redeposited the funds back into Binance.

Such active accumulation from large players has often been followed by a major reversal and bullish sentiment in the market.

ETH Coin Correction Heading for A Major Support Test

Since the mid-December top, the Ethereum price has witnessed a major downturn from $4,108 to $3,041— a 26% decrease. Analysis of the correction in the daily chart reveals the formation of a classic reversal pattern called head and shoulder.

The chart setup shows three peaks— with the middle one extending higher than the two nearly same height shoulders. With an intraday loss of 7.3%, the ETH price shows a major breakdown below the $3,120 neckline and 200-day EMA.

If the breakdown holds, the coin sellers push the asset 14.5% down to retest a dynamic support trendline intact since October 2023. A further breakdown from this level could drive an extended correction to the yearly support trendline at $2,100.

On the contrary, if Ethereum price fails H&S breakdown, the buyers could counterattack and invalidate the bearish thesis.

Also Read: Bitcoin ETFs Celebrate 1st Anniversary with $95B Milestone