On Wednesday, March 19th, the crypto market witnessed a bullish turnaround following the Federal Reserve’s decision to keep the interest rate unchanged. As a result, the Bitcoin price bounced 5% to breach $85,000 resistance, while the major altcoins like AAVE showed a reversal opportunity from major support. Despite the renewed market sentiment, a sudden record of whale selling pressure puts AAVE’s price at risk of support breakdown.

Key Highlights:

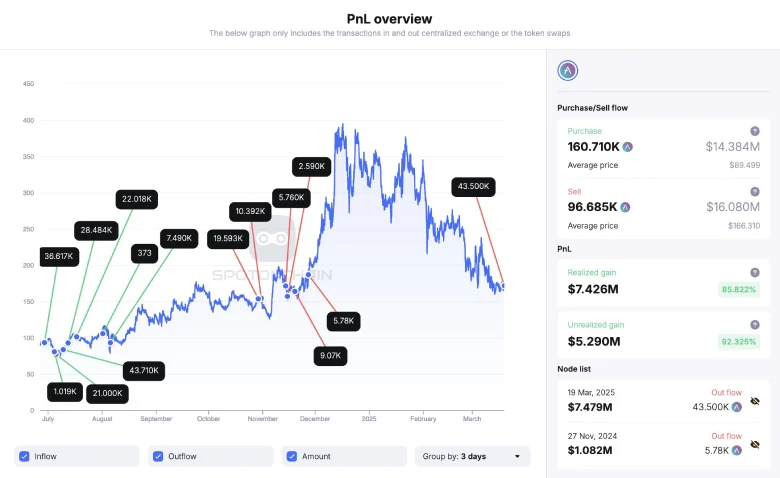

- A whale deposited 43,500 AAVE worth approximately $7.48 million to FalconX after four months of inactivity. This has raised concerns about potential selling pressure.

- Since late January 2025, the AAVE price correction has been resonating strictly within two converging trendlines, revealing the formation of a wedge pattern.

- A potential bearish crossover between the 50-and-200-day Exponential Moving Average could intensify market selling pressure and drive a prolonged downfall.

Whale Activity Puts AAVE’s Bullish Momentum at Risk

According to onchain data tractor Spotonchain, a significant whale deposited 43,500 AAVE (worth approximately $7.48 million) to FalconX earlier today. This comes after a long period of inactivity, lasting around four months.

Currently, the whale still holds 67,426 AAVE, valued at $11.61 million. With this latest deposit, the total estimated profit from the whale’s AAVE holdings now stands at an impressive $12.72 million, reflecting a gain of 88.4%.

Generally, such large-holder selling creates a negative momentum for coin price and restricts its growth potential if the trend continues.

AAVE Price Shows Impending Breakout from Wedge Pattern

Since last week, the AAVE price has recorded a bullish turnaround from the $160 low to the $182 current trading value, registering a 15% growth. This reversal marks a fresh bull cycle with the formation of a falling wedge pattern — a technical chart setup characterized by two converging trendlines.

Historically, each reversal from the bottom support has bolstered buyers with renewed recovery to challenge overhead resistance. If the pattern holds, the AAVE price could surge another 4.5% to challenge the wedge resistance at $190.

The potential breakout with daily candle closing will accelerate the market buying pressure and signal the end of the prevailing correction trend. With sustained buying, the AAVE price could surpass the $278 barrier, and challenge the key resistance zine at $390.

Also Read: First-Ever Solana ETFs Launches Tomorrow; Will SOL Price Breakout?