LINK, the cryptocurrency of the decentralized oracle network Chainlink is down 4% during Friday’s U.S. market session. The pullback follows broader market uncertainty as Bitcoin struggles to hold a $100k level. However, an active accumulation of institutions and whales hints the Chainlink price potential renewed bullish momentum for a higher rally.

According to Coinmarketcap, the LINK price currently trades at $27.8, while the market cap is at $17.46 Billion and 24-hour trading of $3.18 Billion.

Key Highlights:

- Chainlink price rally backed by whale accumulation signals a potential surge to the $40 mark.

- A high-value average directional index signaled the LINK price soon hit exhaustion and witnessed another pullback to revive buying pressure.

- The fast-moving 20-day exponential moving average offers immediate support for buyers amid market correction.

Trump-Linked Fund and Whales Drive Chainlink Price Rally

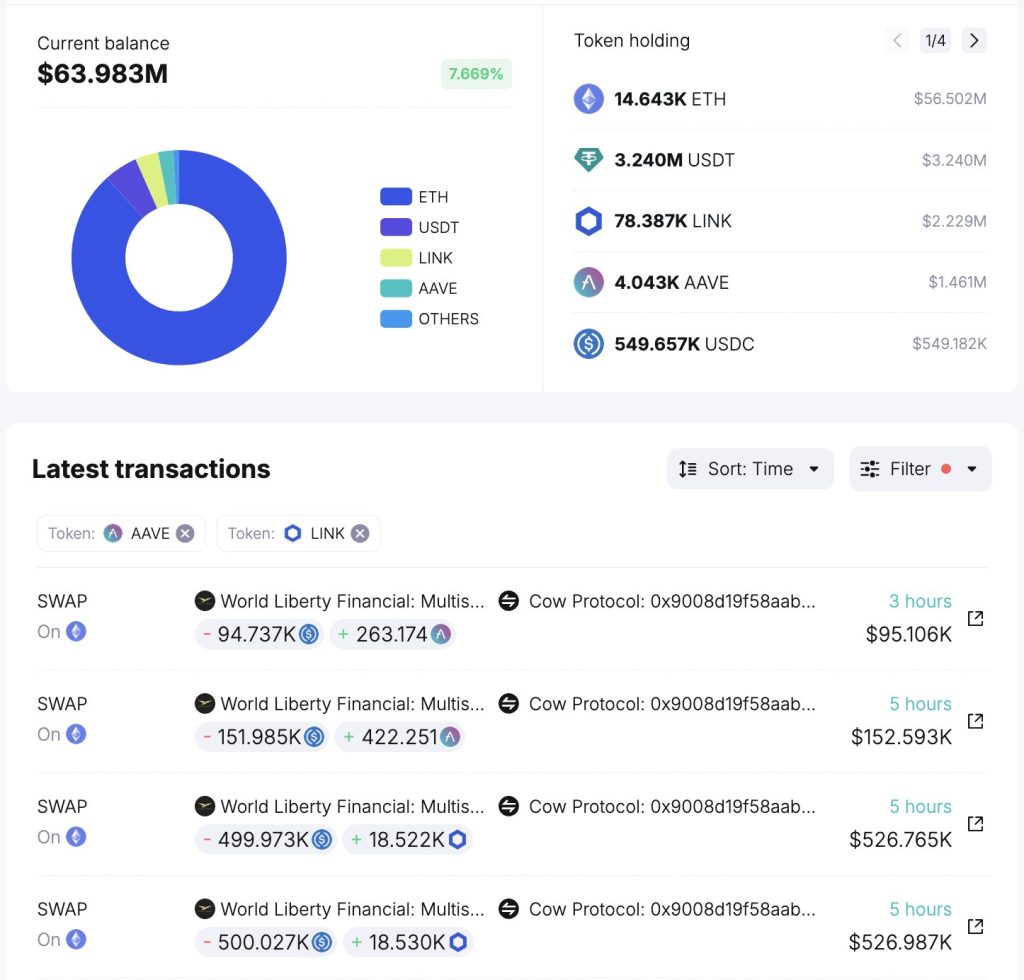

Institutional and whale activity around Chainlink (LINK) and Aave (AAVE) has intensified, as Donald Trump’s World Liberty Financial Fund and key crypto whales have made substantial acquisitions.

According to SpotOnChain, the fund has spent $2 million, accumulating 78,387 LINK and $1.25 million for 4,043 AAVE, both at significant gains of 11.6% and 17.4%, respectively.

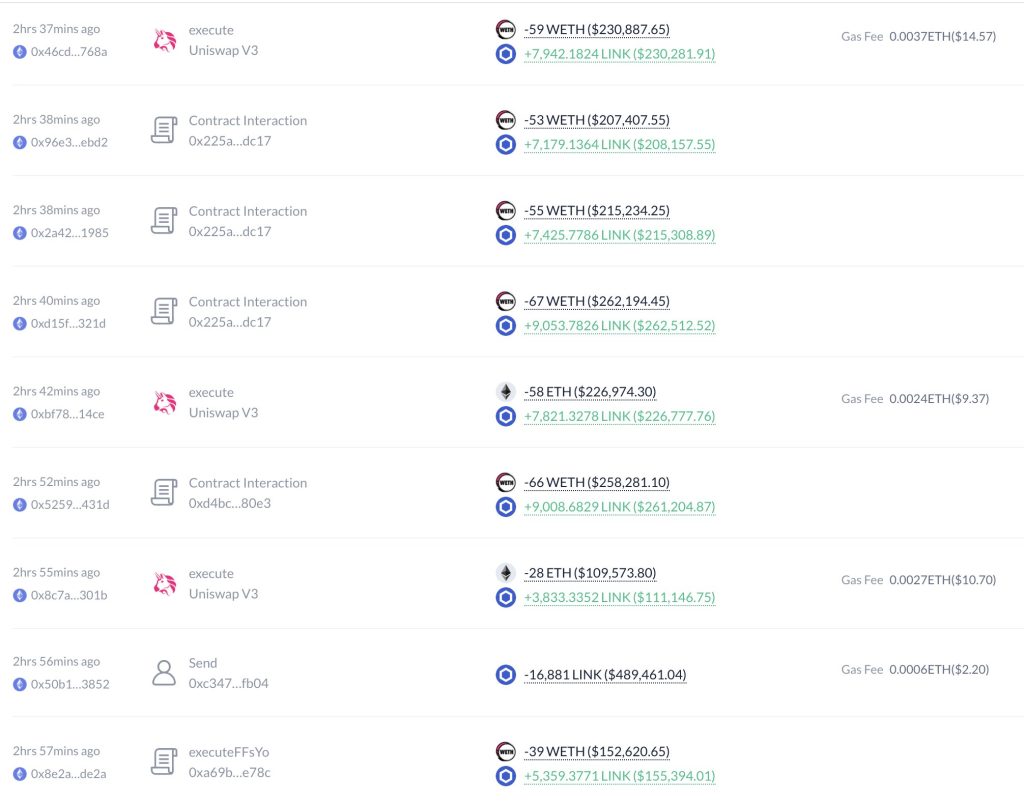

Meanwhile, Lookonchain reports a whale has poured 1,263 ETH ($4.94 million) to buy 175,424 LINK at an average price of $28.18 on December 12th.

Such active investment accentuates the institution and whale confidence in LINK’s future growth potential. Historically, large investors’ activity has recorded major movement in an asset, such as a trend reversal or potential breakout for higher rallies.

Chainlink Price Analysis: Overhead Supply Limits Rally Potential

In the first half of December, the Chainlink price showed a stalled bullish momentum as overhead supply at $30 limited buyers’ attempts. The selling pressure, highlighted by long-wick rejection candles in LINK’s daily chart, hints at a possible reversal in the near future.

The anticipated pullback could plunge the asset by 18% to retest the 20-day EMA support around $22.5. Since mid-November, this dynamic support has bolstered buyers to recuperate the bullish momentum and maintain a sustained recovery.

Until this support holds, the Chainlink price drives a high-momentum rally with the potential to challenge the $40.

However, the momentum indicator ADX spike to 47% signals an already overextended rally in the daily chart. Thus, the LINK price rally to $40 is less likely in two weeks until boosted by external supporting news.