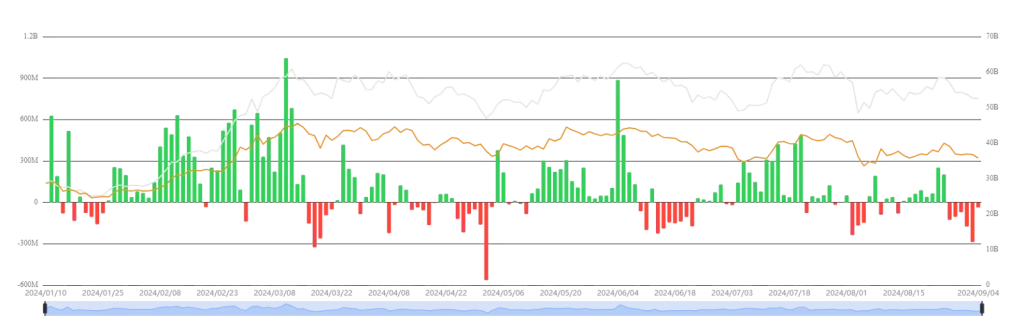

As of September 4th, Spot Ethereum has witnessed a colossal net outflow of $37.51 million, with Grayscale Ethereum ETFs leading the race. ETHE saw a net outflow of $40.62 million, while the Mini Trust ETH accounted for over $3 million in net outflows. Other ETF issuers did not have any inflow or outflow as of September 4th. This brings the cumulative net outflow for the Ethereum ETF to $562 million. The net asset ratio is 2.28% of Ethereum’s market cap.

On the other hand, Spot Bitcoin ETF saw $27 billion in net inflows. Similar to Ethereum ETFs, Grayscale also had a net outflow of $34.25 million, the sixth day of an entire week of outflow. Fidelity’s FBTC saw a net outflow of $7.59 million, with BlackRock’s IBIT accounting for no inflow or outflow. Currently, the total net inflow for Bitcoin ETFs is $17.27B.

Also Read: Former Mt. Gox CEO announces EllipX, a transparent crypto exchange

The crypto market capitalization has tanked 1.5% after NVIDIA stocks fell on Wednesday. While there has been no specific news that caused the stocks to tip off, its effects have tumbled over to the crypto market, with the assets of both Bitcoin and Ethereum taking the blow. As of September 5th, Bitcoin is trading at $57,212.4 while Ethereum is trading at $2410.7, showing gradual signs of market recovery.