During Friday’s U.S. trading session, the crypto market witnessed a slight downtick despite U.S. President Trump signing an executive order for a Strategic Bitcoin Reserve. The bitcoin price plunged below the $90,000 mark, maintaining a correction settlement intact in the altcoin market. If the market downturn continues, the Uniswap price faces a risk of another breakdown as significant supply volume hits exchanges.

Key Highlights:

- A falling wedge pattern drives the current correction in UNI.

- 5.20 million UNI tokens were transferred to exchanges in two weeks, indicating strong sell-off potential.

- The Uniswap price breakdown below the 78.6% Fibonacci retracement level indicates the buyers have a weak hold over the asset.

UNI Price Under Pressure Amid Exchange Inflows

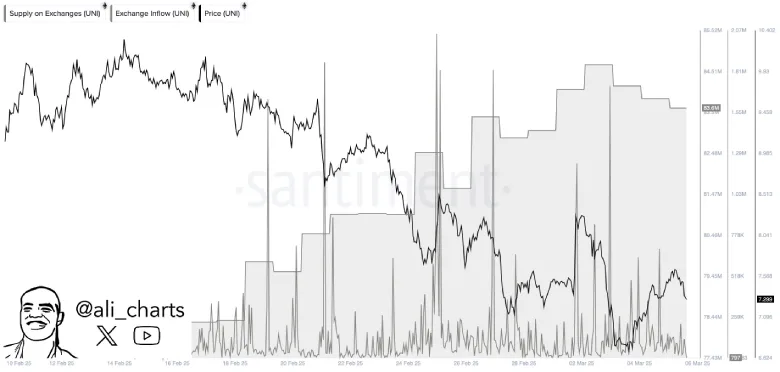

In the past two weeks, a substantial 5.20 million UNI tokens were transferred to exchanges, according to a recent chart shared by crypto analyst Ali Martinez. Such substantial inflows often indicate an impending sell-off or profit-taking sentiment among investors, potentially signaling bearish expectations regarding UNI’s near-term price trajectory.

Amid the current correction trend, this exchange inflow could further accelerate the market selling pressure and plunge Uniswap’s price to bottom levels.

Falling Wedge Pattern Suggests Possible Reversal Ahead

In the last three months, the Uniswap price has witnessed a high-momentum downtrend from $19.47 to $7.25 current price value, registering a loss of 62%. Consecutively, the asset market cap plunged to $4.36 Billion.

The falling price has pierced down from key daily EMAs (20, 50, 100, and 200) and lost the support of the Fibonacci retracement level. With sustained selling, the UNI price could plunge another 22% to test the support of a long-coming ascending trendline.

Historical data shows a reversal from this support led to a surge ranging from $314-$340.

In addition, the Uniswap price daily chart shows the current correction is actively resonating within a falling wedge pattern. Theoretically, the converging trendline indicates diminishing bearish momentum and buyers making constant attempts for a bullish breakout.

Thus, the risk-averse could wait for an upside breakout from the wedge pattern to confirm price recovery.

Also Read: Ethereum Price Eyes $3,000 Rebound as $500M ETH Exits Exchanges