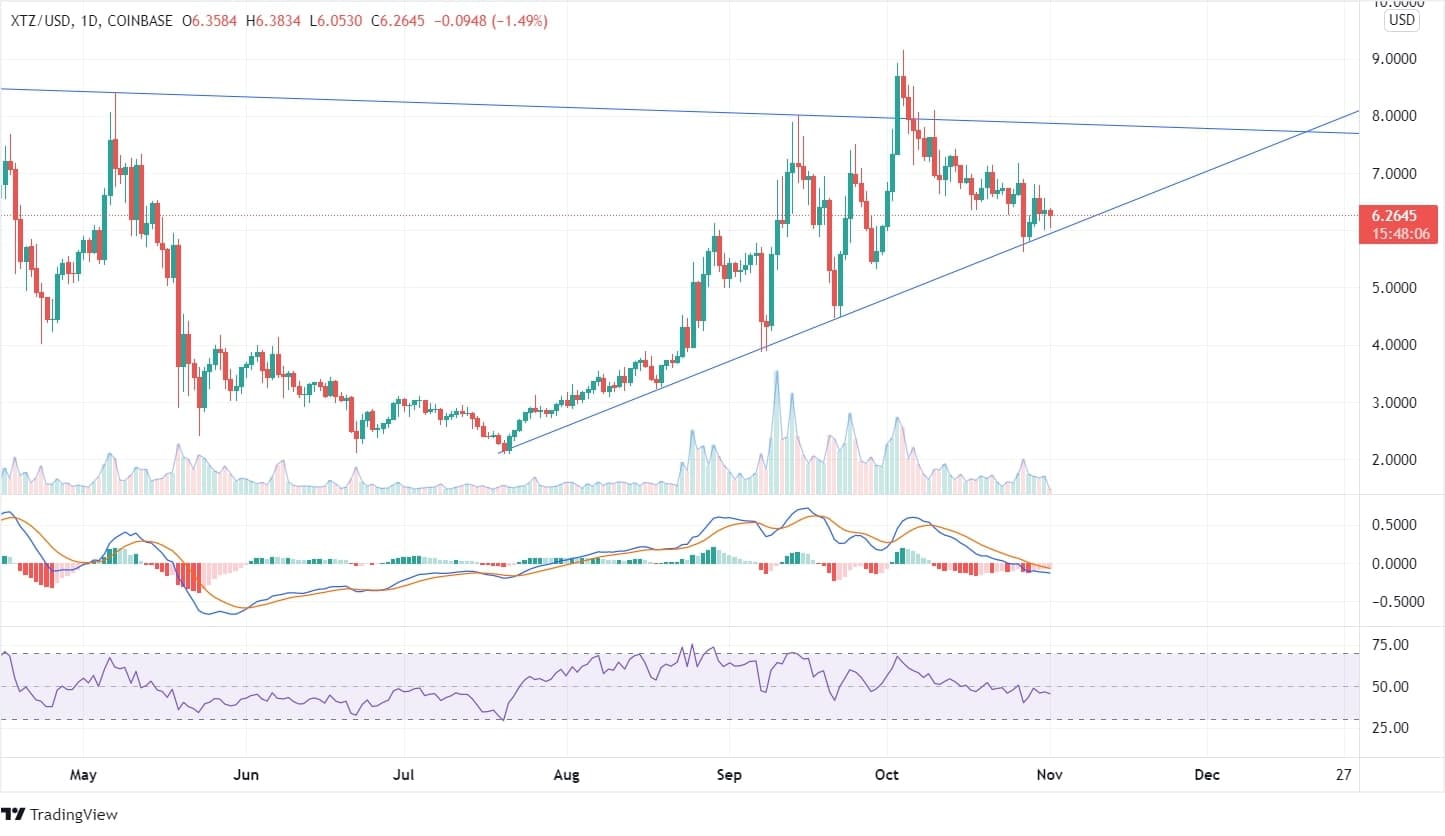

The XTZ coin was at its high on October 04 at $9.00. In the period of August to beginning of October the coin has given a return of 300% to its investors with the price movement constantly following the uptrend line. The Tezos price is currently moving at the support of uptrend line and it can be a strong point for bulls and bears depending on upcoming candles.

From the highs of $9.14 the price fell down to its support of $6.00. Though the Tezos price tested the trend line but it failed to descend and is evolving at the edges of trend line. If the coin crosses the trend line and moves down, we can expect a bearish price move.

Longer-term charts such as the weekly show that prices have quite recently tested the very near-term resistance formed at the peak of the last upswing, with highs of around $8.40 seen in the first week of May 21. Tezos prices did breach and close above the aforementioned level on the weekly chart but quickly took a U-turn to get dismissed back to a range of around $6.00 where it is currently consolidating.

The current price movement of XTZ crypto from just $2.00 to over $9.00 in a span of under 3 weeks was an impressive affair. This rapid price rise does not appear to be a mere impulsive move on part of the buyers, as we do notice a healthy build-up of volume along with the increasing prices. In fact, volumes on the recent up-swing even exceeded volumes witnessed on up-swings in the past couple of Years.

On the daily time frame prices have reached back and are reacting to the up trendline formed by connecting the higher lows of the most recent upswing. A healthy downward rejection of this line, coupled with strong volume on an up move may bring new opportunities for market bulls to open fresh positions. Investors who desire to go long must remain cautious though and keep their heads down until we see prices breaking the $7.00 mark and closing comfortably beyond for initiating any new positions as that would generate a more favourable risk to reward scenario.