In February’s second half, the crypto market remained under pressure as top assets like Solana were bracing for impact ahead of a significant token unlock. The consolidation trend in Bitcoin and Ethereum adds to broader market uncertainty and limits the recovery potential in altcoin. However, a sudden surge in whale accumulation offers an opportunity for SOL to bottom its correction and rebound higher.

Key Highlights:

- The Solana price correction witnessing a surge in whale accumulation signals the market participants following a buy-the-dip sentiment.

- The coin price struggle to follow up on the $175.5 breakdown signals weakness in sellers’ strength.

- A 50-day exponential moving average could continue to act as dynamic resistance against SOL.

SOL’s Correction Deepens, But Whale Activity Hints at a Recovery

Over the past months, the Solana price fell from $295 high to $170 current trading price, registering a loss of 42%. While the broader market uncertainty initiated this downfall, the recent memecoin controversy of LIBRA and the upcoming token unlock of 11.2 million SOL tokens on March 1 maintain the bearish momentum.

Hedging flows tied to FTX-related SOL are signaling potential supply pressure that could prolong Solana price correction.

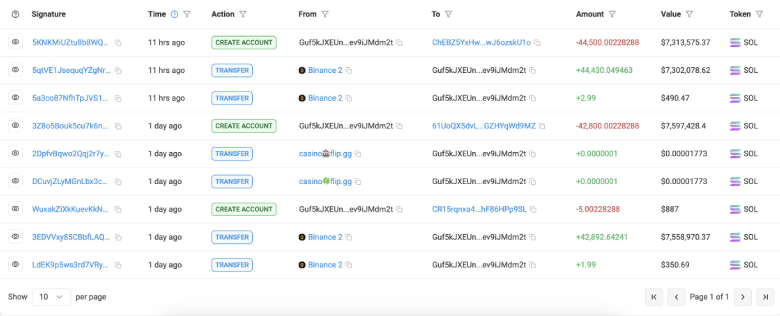

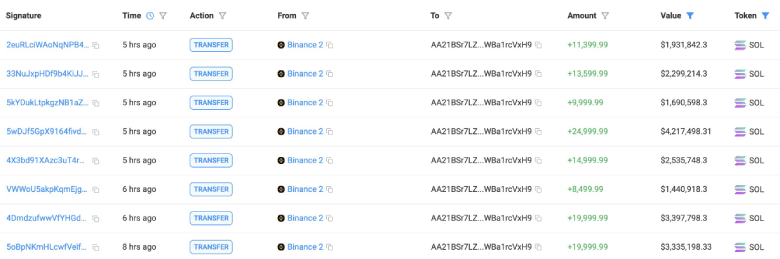

However, the blockchain analytics platform Lookonchain flagged a massive withdrawal from Binance by Solana whales. The transaction details show that the wallet “AA21…VxH9” withdrew 123,500 SOL, equivalent to $20.8 million, in multiple transactions earlier today.

Meanwhile, a newly created wallet withdrew 87,328 SOL ($14.8M) from Binance over two days. According to blockchain data, the wallet immediately staked the entire amount, reinforcing the bullish sentiment around Solana’s staking yield.

Amid a significant downfall, this accumulation indicates that large investors are interested in SOL’s discounted value with their expectation for a renewed recovery trend.

Fake Breakdown Hints For Solana Price Recovery

On February 18th, the Solana price gave a decisive breakdown from the $175.5 support of the double top pattern. This chart setup displays an ‘M’ shape reversal and prompts a major market downturn.

A potential negative crossover between the 20-and-100-day EMA slope hints at escaping bearish sentiment among traders. If the pattern holds true, the SOL price could plunge 40% from the current trading price, hitting a low of $92.

On the contrary, a 0.74% surge in Solana price today shows a lack of follow-up on the downside. Amid whale accumulation, if the coin price rebounds above $175 in the coming days, the previous breakdown could be marked as failed.

This potential bear trap could result in substantial short liquidation and drive buying pressure up.

Also Read: Binance.US Restores USD Deposits & Withdrawals With Zero Fees