On February 26th, Wednesday, the crypto market continues to struggle under persistent bearish momentum as Bitcoin extends its correction below $90,000. With bearish sentiment spreading across the altcoin market, the top assets like Solana are experiencing a significant correction, edging closure to key support levels. Amid active whale seeling and a sharp decline in SOL’s transfer volume, this coin appears vulnerable to further downside.

Key Highlights:

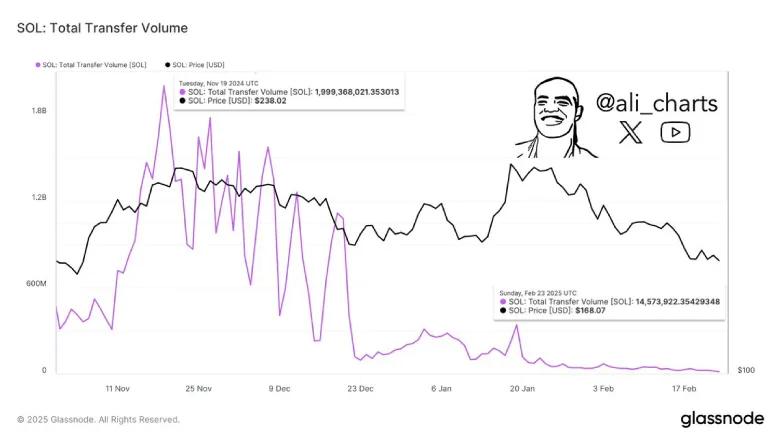

- SOL’s total transfer volume has plummeted from $1.99 billion (Nov 2024) to $14.57M, reflecting a sharp drop in on-chain transactions.

- The Solana price correction is poised to retest yearly support of $120 to recuperate the bullish momentum.

- A potential bearish crossover between 50- and 200-day EMA will intensify the market selling pressure for a $120 support breakdown.

SOL Faces Sell Pressure as Whale Moves $198M SOL

According to on-chain data from Lookonchain, a large entity unstaked 1,366,028 SOL (valued at $198 million) and transferred it to FalconX just seven hours before reporting. Following this, FalconX deposited 440,202 SOL ($62.6 million) into Binance and Coinbase, indicating potential sell pressure on the market.

A whale unstaked 1,366,028 $SOL($198M) and transferred to #FalconX 7 hours ago.#FalconX has deposited 440,202 $SOL($62.6M) to #Binance and #Coinbase in the past 7 hours.https://t.co/5Nvenc4Gh8 pic.twitter.com/gachaLLc1a

— Lookonchain (@lookonchain) February 26, 2025

Amid the current market correction, such a whale exodus could further add selling pressure and escalate negative sentiment among investors.

Meanwhile, analyst Ali Martinez highlighted a concerning trend in Solana’s network activity. Solana’s total transfer volume has plunged from $1.99 billion in November 2024 to a mere $14.57 million today, marking a dramatic drop in on-chain engagement.

The declining trend signals reduced investors’ participation and potential liquidity concerns, backing the risk of a prolonged correction.

Solana Price Nearing Major Support Test

In the last five weeks, the Solana price witnessed a V-top reversal from $295 high to $138 currently trading, projecting a 54% loss in value. The falling price, backed by increasing volume and breakdown below key daily EMAs (20, 50, 100, and 200), indicates strong sellers’ conviction.

With sustained selling, the coin price is poised for a 12% drop before testing the yearly support of $120. Historical data shows a reversal from this support has bolstered the rally ranging from 60-120%, indicating a high accumulation zone.

The Solana price will likely receive a surge in buying pressure at this support and shift the downward trend sideways for the coming weeks. If the support holds, the coin price could prepare for a bullish reversal with a potential breakdown past $175.

Also Read: Pump.Fun’s X Account Hacked to Promote Fake Token