On Thursday, March 13th, the crypto market experienced a notable downtick as a tariff war escalated between the United States and the European Union. Thus, the Bitcoin price reverted from $85,000 and surged selling pressure on most major altcoins including SOL. The Solana faces the risk of a prolonged correction below $100 as new addresses continue to decline and the Funding Rate turns bearish.

Key Highlights:

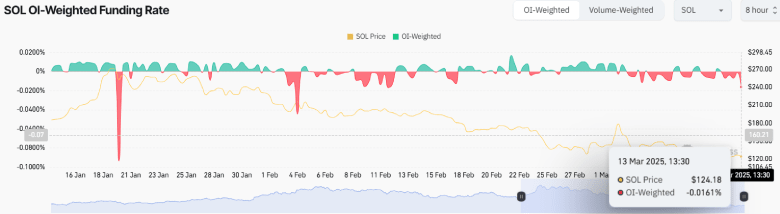

- Solana’s OI-Weighted Funding Rate has fallen to 0.0161%, signaling bearish sentiment in the derivatives market.

- The Solana price is 4% short from teasing a bearish breakdown from the 12-month support zone.

- A potential death crossover between 100-and-200-day EMA raises the risk of prolonged correction below $100.

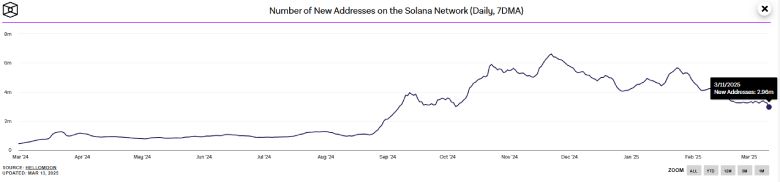

Solana Price Breakdown Looms as New Addresses Drop to 9-Month Low

Since last week, the Solana price has plunged from $141 to $123 current trading value, registering a loss of 13.2%. Amid this pullback, the number of new addresses on the Solana network has plunged by 2.92 Million — its lowest level since June 2024.

The declining trend hints at weakening network growth and declining user adoption, which could further dampen investor sentiment.

Adding to the bearish note, the OI-Weighted Funding Rate of Solana has slid to 0.0161%, indicating a shift toward bearish dominance in the derivatives market as traders turn risk-averse

Historical data shows that a spike of this metric into negative territory has often triggered increased selling pressure, leading to a prolonged downtrend in SOL price. If the funding rate flips negative, it may indicate further downside potential, as short sellers gain more control, potentially dragging SOL toward the $120 support zone.

SOL Faces Risk of Losing 12-Month Support

In the last two months, the Solana price has witnessed a high-momentum downtrend from $295.8 to $122.04, accounting for a 58.75% loss. The correction trend breaks below the daily EMAs (20, 50, 100, and 200) and loses major support of 50% retracement level.

In addition, the daily chart shows the 100-day EMA slope is on the verge of falling below the 200-day EMA slope for the first time in 500 days. If a death crossover occurs, the selling pressure will intensify in the Solana price correction and bolster a breakdown below $120.

A bearish breakdown below this multi-month support with a daily candle closing will further reinforce the downward momentum and push the price below $100 floor.

Conversely, the $120 floor has acted as a major accumulation trend for buyers since March 2024. Thus, a renewed demand pressure at this support will allow buyers to counter-attack.

Also Read: Ripple Secures DFSA License To Offer Crypto Payments in UAE, XRP Surges Over 1.5%