The S&P 500 extended its decline yesterday following reports of job openings decreasing to a 3-and-a-half-year low in July. Amidst all this, on September 5th, the TD Sequential Indicator hinted at a ‘buy’ signal, hinting that the downward trend might be running out of steam and prices might take an uptick in the near future.

Solana’s price increased from $129.09 to $132.19 after enduring a storm on Wednesday. The Nifty disrupted its trajectory by dipping below the trend line on the chart.

This signal hints that the selling pressure is pretty close to fading out, and buyers might soon start driving up the prices. While this does not necessarily claim that a bull run will commence, there is a possibility for a short-term bullish sentiment in the market. A rebound can be expected, and traders can use this moment to capitalize on the market.

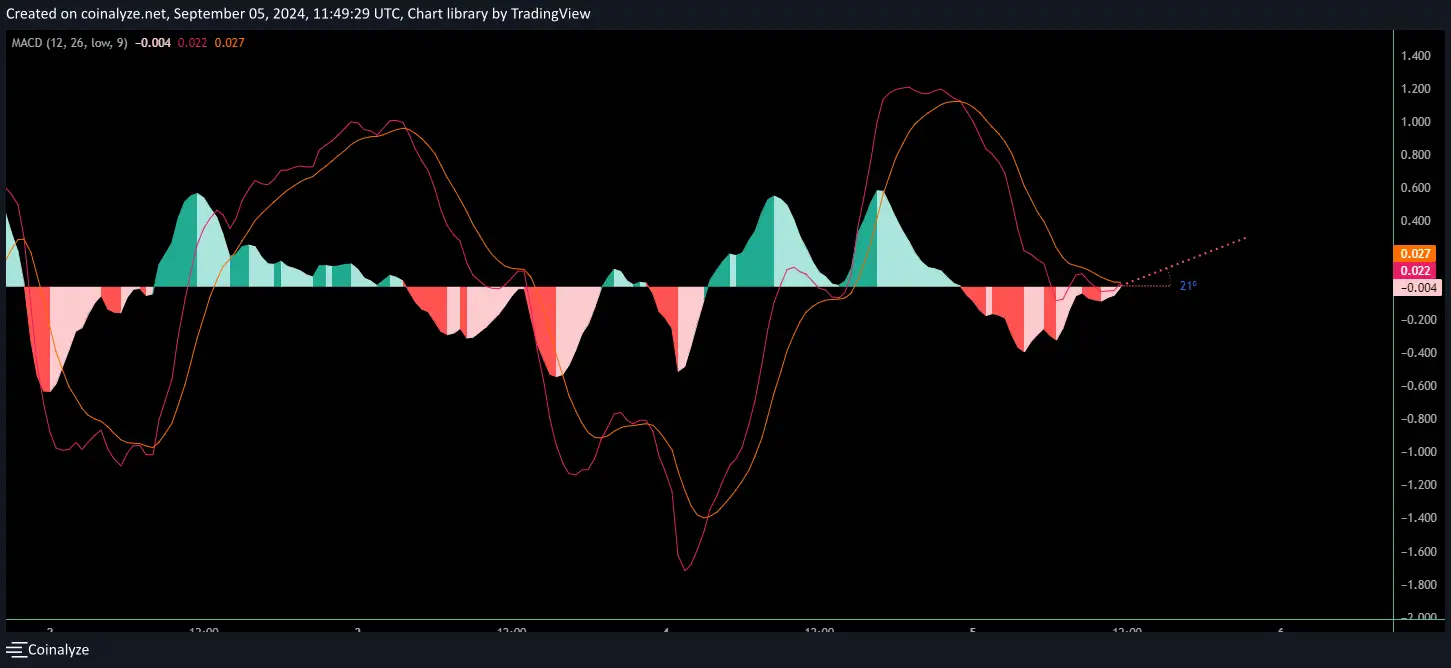

Looking at the technical chart, the MACD value is -0.004. The ongoing trend is bearish, with the potential for a trend reversal. The histograms, which were previously more extensive in size, are shrinking, even though they are in the negative parameters. The current market is in a consolidation phase where the bearish momentum is slowly losing steam. A trend reversal is on the horizon as the MACD line attempts to crossover the Signal line. Traders are free to interpret this as a buying opportunity, with prices likely to go further up. In the case the crossover has an increase in volume, the market sentiment can be strongly bullish. As of now, Solana is priced at $133.04, which can uptick to the $136 to $137 mark in the short bull run. However, in a long-term bull market, traders may expect a price range of the $145 to $153 mark.