In the final week of February, the crypto market witnessed a bloodbath as the broader market plunged following Donald Trump’s decision to implement tariffs on Canada and Mexico. Thus, the Ethereum price has dropped over 15% in the last 48 hours, heading for a major support test. ETH analysis shows potential for a rebound as the U.S. SEC acknowledged Grayscale filing to allow staking for its spot Ethereum ETF.

Key Highlights:

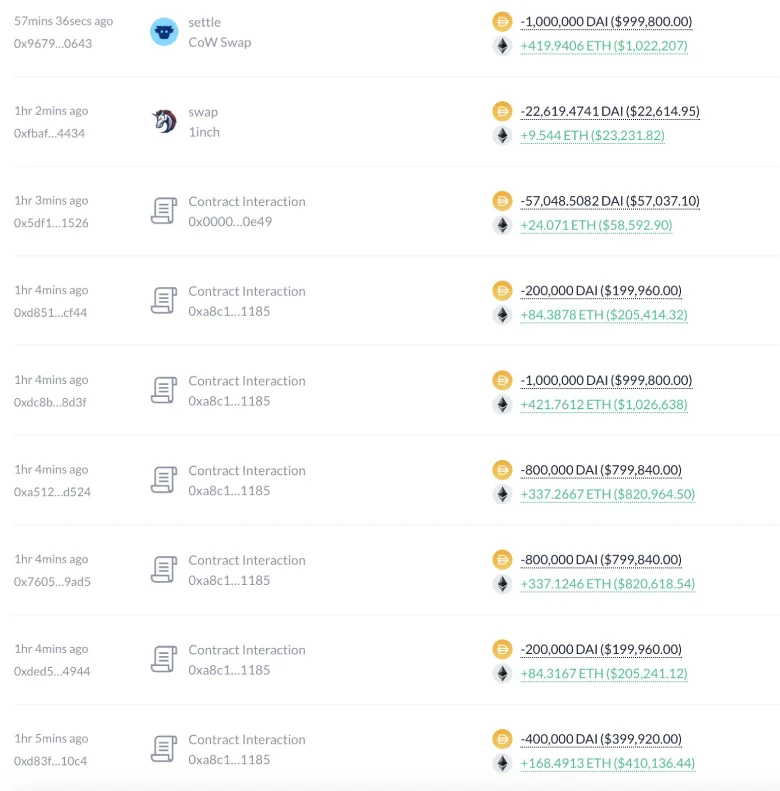

- Despite a market decline, on-chain data shows that 7 Siblings spent $28.75M DAI to purchase 12,070 ETH.

- In the daily chart, a downsloping trendline displays the current pace of ETH correction.

- The Ethereum price could plunge another 12% before retesting a multi-year support trendline.

SEC Acknowledges Grayscale’s Filing to Enable Staking for Spot Ethereum ETF

On February 25th, Tuesday the U.S. Securities and Exchange Commission (SEC) acknowledged Grayscale’s filing, which sought approval to allow staking for its Spot Ethereum ETF.

The announcement signals a potential shift in regulatory attitudes toward integrating staking mechanisms within traditional financial instruments. If approved, this move would allow Grayscale’s Spot Ethereum ETF to participate in Ethereum’s proof-of-stake (PoS) consensus mechanism, potentially generating staking rewards for investors while maintaining its classification as an exchange-traded fund.

Adding to the bullish notes, certain entities have started accumulating ETH despite the recent downfall. According to Lookonchain data, 7 Siblings spent 28.75M DAI to buy 12,070 ETH at $2,382 again. The report shows the 7 Siblings currently hold a total of 1.15M ETH(worth approximately $2.8 Billion) across two wallets.

Such large accumulation during market dips hints the investors follow buy-the-dip sentiment, which typically maintains a steady uptrend and reinforces bullish momentum.

ETH Price Heading for Major Support Retest

The Ethereum price correction displayed a series of lower highs and lower lows formation, indicating a sustained downtrend with sellers in control. Connecting the peaks of this retracement trend reveals a downsloping trendline, which acts as key dynamic resistance for sellers.

By the press time, the ETH price trades at $2,480 with an intraday loss of over 2%. With sustained selling, the coin price could plunge another 12% before retesting a major support trendline.

Since mid-June 2022, the ascending trendline has acted as a crucial accumulation point for buyers, as it has a history of bolstering major price recovery. While the ETH price could hover above this support in the coming weeks to recuperate bullish momentum, a potential reversal could chase a $4,000 high.

Also Read: Du Jun on Infini Attack: $50 Million Loss is an “Entry-Level Trial-and-Error Cost”