On Wednesday, March 19th, the XRP price recorded a 12% surge to trade at $2.5. This uptick followed Ripple CEO, Brad Garlinghouse’s announcement that the U.S. Securities and Exchange Commission has officially dropped its long-coming lawsuit against the blockchain company over XRP sales. The renewed recovery, accompanied by a surge in XRP’s Open Interest indicated potential for a new breakout.

Key Highlights:

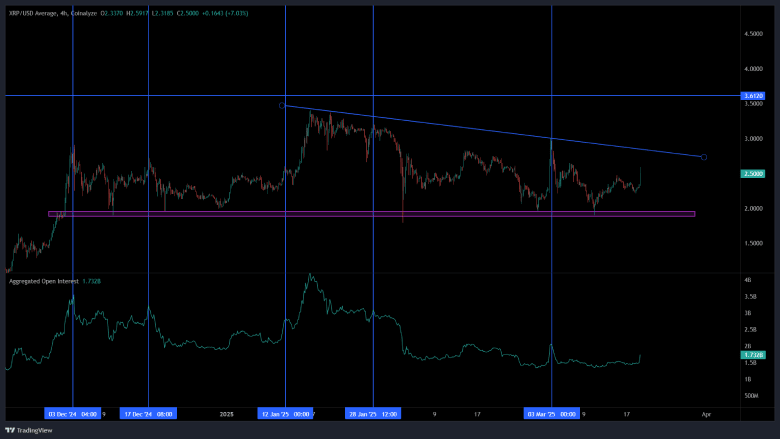

- The XRP price is 18% short from a bullish breakout of the downsloping resistance trendline.

- A sharp recovery in XRP’s aggregated open interest has showcased a history of potential price reversal.

- While the SEC has dropped its appeal, Ripple’s ongoing appeal against the $125 million fine and sales restrictions adds another layer of uncertainty.

Ripple Celebrates Victory as SEC Ends Legal Fight Over XRP Sales

The 4 years long legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) appears to be nearing its conclusion with the SEC’s decision to drop its appeal. Ripple’s CEO, Brad Garlinghouse, shared the news with optimism, calling it a victory for the company, the cryptocurrency industry, and the broader market.

The case, which dates back to December 2020, involved the SEC accusing Ripple of selling XRP as an unregistered security, raising over $1.3 billion in the process. A court ruling in July 2023 initially favored Ripple by declaring XRP not to be a security in retail transactions.

However, the court imposed a $125 million fine and banned institutional sales of XRP in 2024. The SEC had appealed this decision in early 2025, but with the announcement of dropping the appeal, the case seems to be coming to an end.

This is it – the moment we’ve been waiting for. The SEC will drop its appeal – a resounding victory for Ripple, for crypto, every way you look at it.

The future is bright. Let’s build. pic.twitter.com/7WsD0C92Cm

— Brad Garlinghouse (@bgarlinghouse) March 19, 2025

This move should clear legal uncertainty around Ripple attracting demand pressure from institutional and retail investors.

Is the Legal Battle Between Ripple and Sec Really Over?

In a recent tweet, Journalist Eleanor Terrett highlighted that while the SEC has agreed to drop the appeal regarding the programmatic/secondary market sales, ripple has not yet agreed to abandon its appeal against the $125 million fine and the ongoing injunction that restricts the company from selling $XRP to institutional investors without registering those sales as securities.

Terrett added “The ball is now in Ripple’s court, as it is technically considered a plaintiff rather than a defendant. Ripple has the option to continue appealing the fine and injunction, or to drop it.”

This adds another layer of uncertainty to the outcome, as the company may choose to fight against the regulatory actions on the aforementioned fronts.

XRP Price Faces Major Reversal Amid Open Interest Spike

Defying the recent market consolidation, the XRP price bounced from $1.9 low to $2.5 current trading price, registering a growth of 33.5%. This upswing highlighted the buyer’s sustainability above the 50% retracement level and 200-day EMA slope, indicating the broader bullish sentiment among investors.

In addition, the aggregated open interest of XRP coin witnessed a sharp surge of +18% to reach $1.73 Billion. Generally, the uptick implies growing market activity and traders are increasingly taking positions in XRP in anticipation of a potential price movement.

However, historical data show a sudden rise in OI value has often coincided with major tops in XRP price, followed by a bearish reversal.

Thus, the rising XRP price could struggle at an overhead resistance trendline with a potential point of contact at $2.7. A bullish breakout from this resistance is crucial for buyers to reclaim the $3 region.

Also Read: Strategy Announces $5M Preferred Stocks Offering to Buy Bitcoin