Since last week, the crypto market entered a renewed correction trend led by the Bitcoin price dive below $95k. As the selling pressure mounts, the Pendle price caught investors’ attention amid its position at crucial support and a substantial transfer of tokens to exchange by the team-owned wallet. Will Pendle buyers lose $4 floor?

Key Highlights:

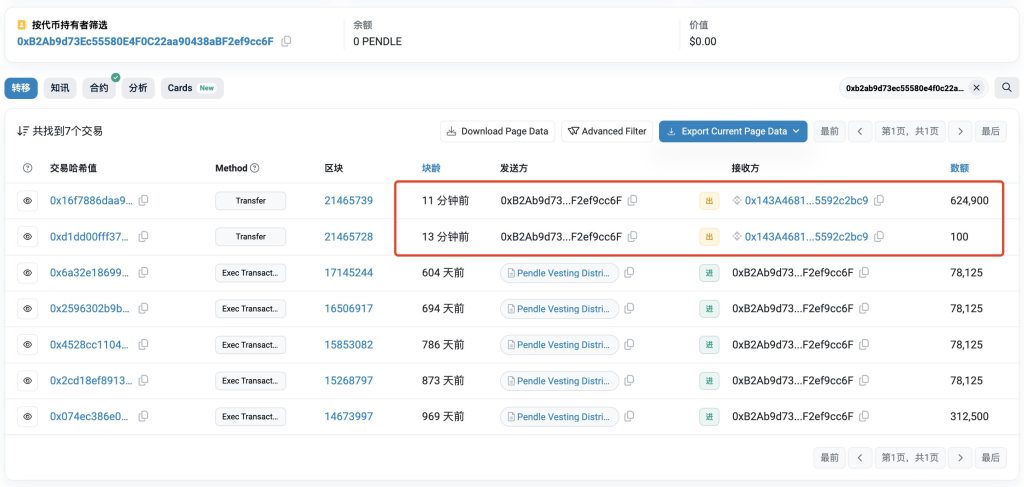

- The Pendle team wallet transfers $625k to the Binance exchange, creating speculation of a potential sell-off.

- The $4.8-$4.56 range is a strong support zone, backed by an ascending trendline, 50% Fibonacci level, and 200-day EMA.

- A breakdown below the dynamic support could drive a correction trend below $4.

Team Wallet Activity Sparks Fear of Sell-Off in Pendle Market

Pendle, a DeFI protocol for trading tokenized future yield, saw its team recently transfer 625,000 PENDLE tokens, valued at approximately $3.15 million, to the Binance exchange. According to a recent tweet by EmberCN, the tokens were unlocked between April 2022 and April 2023, following Pendle’s official unlocking rules. This address, identified as belonging to the team, reflects activity related to the token release schedule.

Generally, a large amount of transfer to a crypto exchange could surge market speculation on potential sell-offs and boost bearish sentiment among traders. If the theory holds, the Pendle could breach $4.8 support for a prolonged correction ahead.

According to Coinmarketcap, the Pendle price exchange hands at $4.9 with an intraday gain of 0.8%. The asset’s market cap holds at $815.1 Million, while the 24-hour trading volume is at $62.5 Million.

Pendle Price Eyes 41% Recovery if Support Holds

Following the Bitcoin correction, the Pendle price witnessed a sharp fall from $7.14 to $5.07, registering a 29% loss. The falling price is currently seeing support at an ascending trendline intact since August 2024.

This dynamic trendline acts as a key pullback support for buyers to recuperate the exhausted bullish momentum. The daily chart analysis further backs the $4.8 to $4.56 support range, accompanied by a 50% FIB level and 200-day EMA.

If the support holds, the Pendle price could rise to 41% to challenge the all-time high resistance at $7.1.

However, a breakdown below the trendline above will accelerate the selling pressure and extend a correction below $4.