Riot Platform, a leading Bitcoin mining company, announced on their X account, a proposal that offers private offering of $500 million in convertible senior notes. The net proceeds that will be obtained from the offering will be used to buy more Bitcoins.

The company’s decision to expand its Bitcoin reserve indicates the fact that the company believes in the long-term value of Bitcoin despite the market volatility.

By leveraging these funds and increasing their Bitcoins, the company seems to be aiming high in order to solidify its position in the Bitcoin mining space.

Michael Saylor Endorses Riot’s Plan

Michael Saylor, Bitcoin advocate and Executive Chairman of MicroStrategy has endorsed Riot’s approach on his X account. In the post, Saylor stated ” Riot is a company on the Bitcoin Standard.” This indicates that he supports Riot’s strategy that is being used.

Saylor’s comment also points to the fact that major corporates these days are embracing Bitcoin as a strategic asset.

Bitcoin Price to Rally?

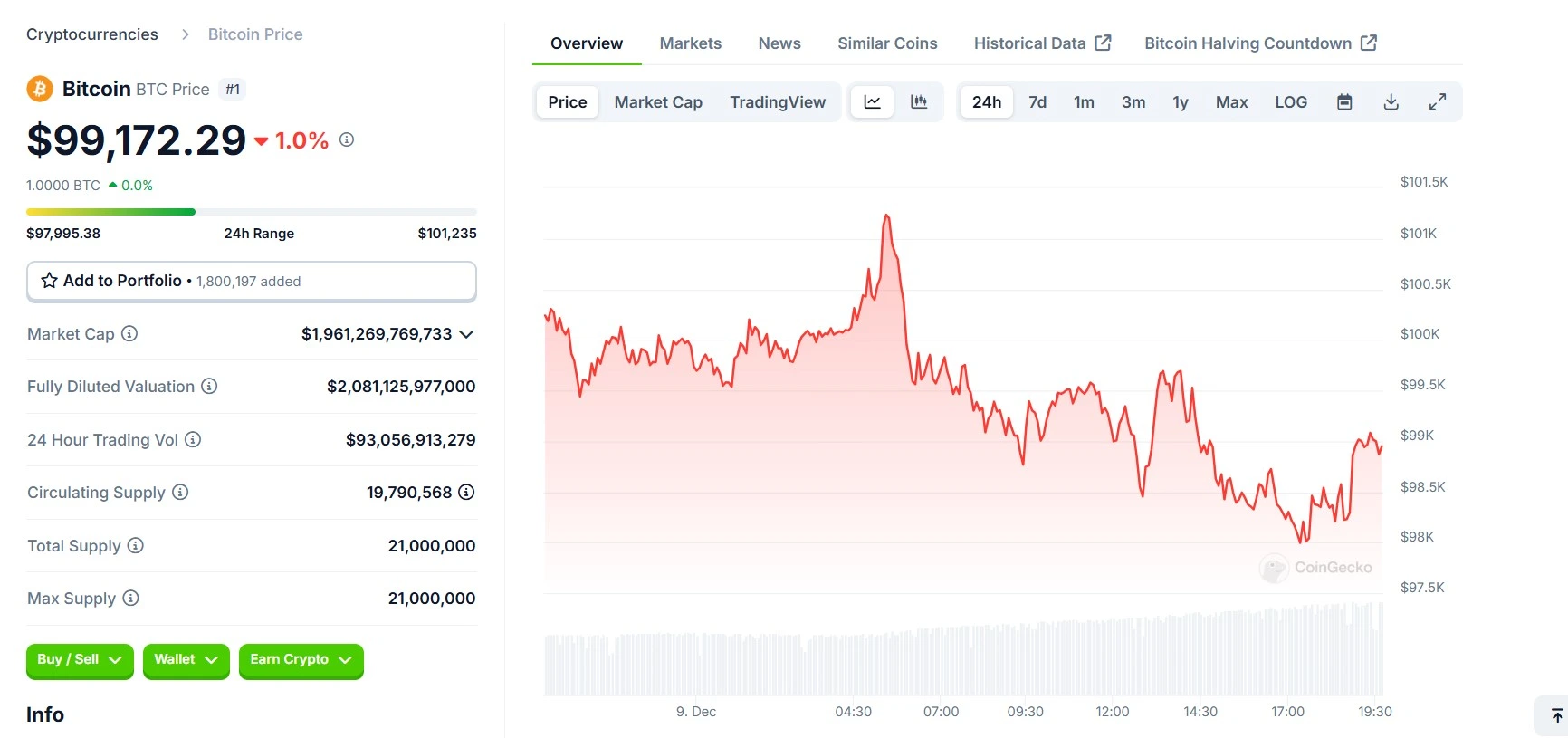

With Riot’s plan to acquire more Bitcoin could have a positive impact on the price of the cryptocurrency. After the purchase, the demand of the token might increase which could lead to significant price rally.

Bitcoin hit the $100,000 mark on December 5, 2024, but could not stabilize for long-period of time. Since then, the token has been trying to cross the $100,000 mark and stabilize. There is a possibility that the liquidation from the future purchases from Riot and MicroStrategy could help Bitcoin reach the $100,000 mark and stabilize.

At press time, the Bitcoin token price stands at $99,712.29 with a dip of 1% in the last 24 hours.

Also Read: Ripple CEO Calls Out SEC for Clearer Rules on 60 Minutes