This week, the crypto market witnessed a notable correction trend following U.S. President Donald Trump’s decision to impose additional tariffs on several countries. As a result, the Bitcoin price plunged below a month’s low of $80k and extended correction in most major altcoins. However, the Litecoin price emerged among a few assets that would end February on a positive note. Is it time for LTC to surpass the multi-year resistance of $140?

Key Highlights:

- The triangle pattern drives current consolidation in Litecoin price before a major upsurge.

- The LTC price above key daily EMAs (20, 50, 100, and 200) accentuates a positive market sentiment for a bullish breakout.

- Over 445,000 active LTC addresses were recorded, marking the highest level since February 1st.

Litecoin Price Rally Strengthens as On-Chain Recovery

Defying the broader market correction, the Litecoin price shows a three-day rally from $114 to $128 current trading value, registering a gain of 12%. Consecutively, the assets market cap surged to $9.68 Billion.

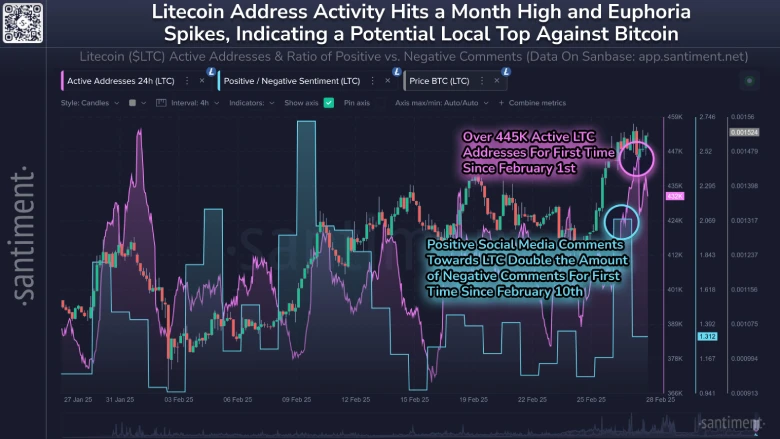

According to Santiment, a leading on-chain analytics firm, the surge in LTC’s dominance is driven by a significant spike in active addresses and a notable rise in bullish sentiment over the past 24 hours.

On-chain data reveals that over 445,000 active LTC addresses were recorded for the first time since February 1st, indicating heightened network engagement. Additionally, positive social media sentiment towards LTC has doubled the number of negative comments, a phenomenon last observed on February 10th.

While the increasing network activity bolsters a sustained recovery momentum in Litecoin price, the heightened positive sentiment could trigger a temporary pullback.

Triangle Pattern Signals LTC’s Next Major Move

For the past two months, the Litecoin price has traded sideways within two converging trendlines of a triangle pattern. The chart setup emerges between an established uptrend and provides buyers with a temporary break to recuperate recovery momentum.

Despite the market correction trend, the recent performance of LTC prices signals the conviction of buyers to escape the current consolidation. As buyers sustain their position above key EMAs (20, 50, 100, and 200), the coin price could rally 5% and breach the triangle trendline.

The post-breakout will surge as a sign for this asset to surpass $141 resistance and conclude a 3-year accumulation trend.

Also Read: Solana Price Risks $120 Breakdown as $324M SOL Hits Coinbase Prime