During Tuesday’s U.S. market session, the Bitcoin price witnessed a surge in selling pressure and plunged below the $100k mark. A 5% drop in price has stalled the prevailing recovery in the altcoin market, signaling a prolonged consolidation before the next breakout. However, an active accumulation of whales and institutions suggests the BTC price may also avoid major correction.

By press time, the BTC price exchange was at $97,068 with a market cap of $1.918 Trillion. Consecutively, the global market cap reverted to $3.5 Trillion, while the 24-hour trading volume is at $183 Billion.

Key Highlights:

- Whale accumulation and institutional adoption continue to bolster Bitcoin price for a quick rebound,

- BTC price shows temporary consolidation below $108,000 to replenish the exhausted bullish momentum.

- The Fibonacci extension tools highlight key resistance at $114,000, followed by $120,000 and $127,000

Bitcoin Price: Whale/ Institutional Interest Drives Bullish Sentiment

According to Lookonchain data, the larger holder continues to accumulate Bitcoin despite its struggle to hold $100k. In a notable transaction, the 3 newly created wallets withdrew 2,173 BTC (worth approximately $221.6 Million) Binance exchange.

Whales continue to accumulate $BTC!

6 hours ago, 3 newly created wallets withdrew 2,173 $BTC($221.6M) from #Binance.https://t.co/sVYcWVjpqhhttps://t.co/5ZhOaf3IOkhttps://t.co/eW4xks21xs pic.twitter.com/iClgYAzK70

— Lookonchain (@lookonchain) January 7, 2025

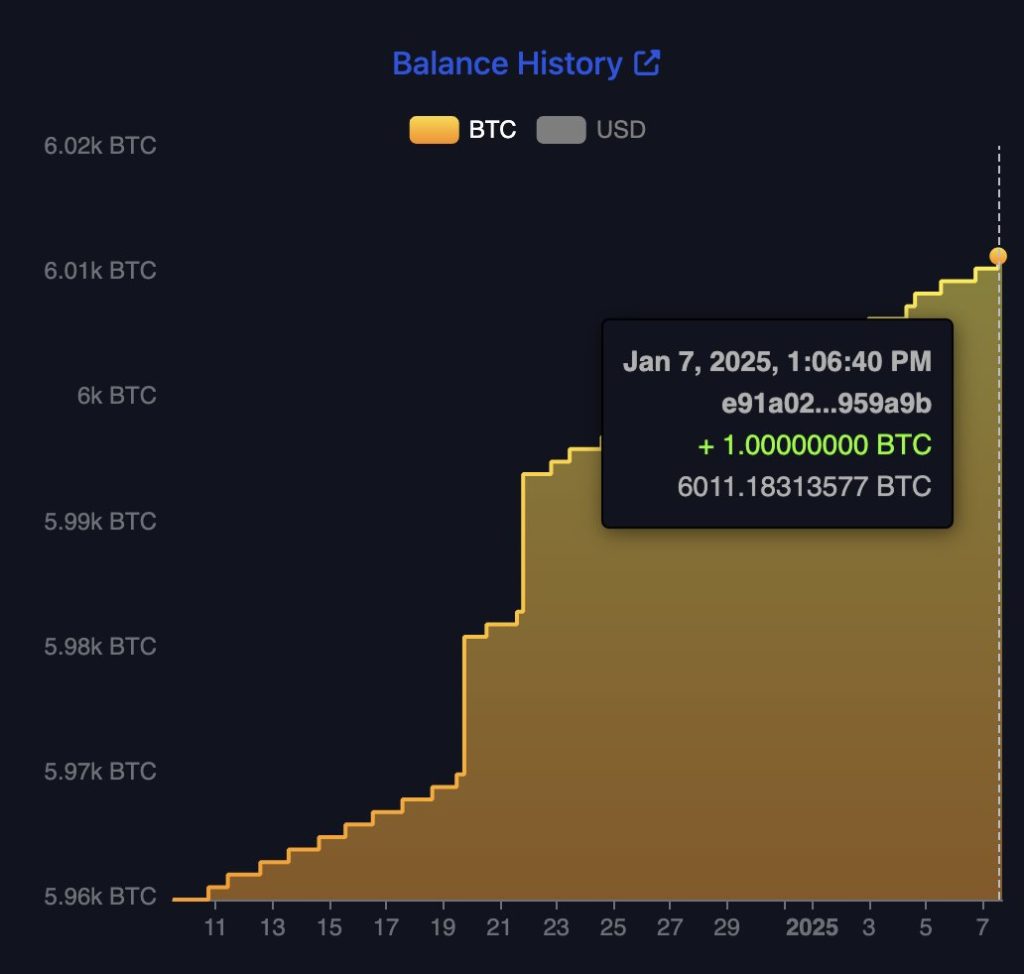

El Salvador continues to strengthen its Bitcoin holdings, adding more BTC to its strategic reserve. As of January 7, 2025, the nation’s Bitcoin balance surpassed 6,011 BTC, showcasing its unwavering confidence in Bitcoin as a national asset.

MicroStrategy, led by Bitcoin advocate Michael Saylor, revealed its purchase of 258,320 BTC for $22 billion in 2024. Furthermore, The Czech Republic’s National Bank Governor expressed interest in Bitcoin as a potential diversification strategy for the country’s reserves.

The combined influence of big players’ accumulation and increasing adoption of BTC has set a positive tone for the asset’s long-term trajectory.

BTC Price Eyes Imminent Breakout

Over the past five weeks, the Bitcoin price has showcased a sideways action, resonating within two horizontal levels of $108,350 and $91,500. Market analysts believe the consolidation could allow buyers to recuperate the exhausted bullish from the 2024 rally.

The BTC daily chart has yet to confirm a sustained recovery push, suggesting that the price action may continue its lateral trend, potentially forming a temporary top at $108,350. However, the asset’s ability to hold above the 100- and 200-day EMAs underscores a bullish long-term Bitcoin price outlook.

In a bullish scenario, buyers could overcome the overhead resistance, paving the way for new highs at $114,000 or even $120,000 in January.

Also Read: Coinbase Uncovers FDIC Letters Revealing Crypto Restrictions in Banking