On Wednesday, March 19, the Solana price recorded a +6% surge to reach its current trading value of $132. Amid the broader market uptick, this price jump followed the upcoming launch of two Solana ETFs in the United States. The renewed recovery from SOL-based products bolsters the price for a key resistance breakout.

Key Highlights:

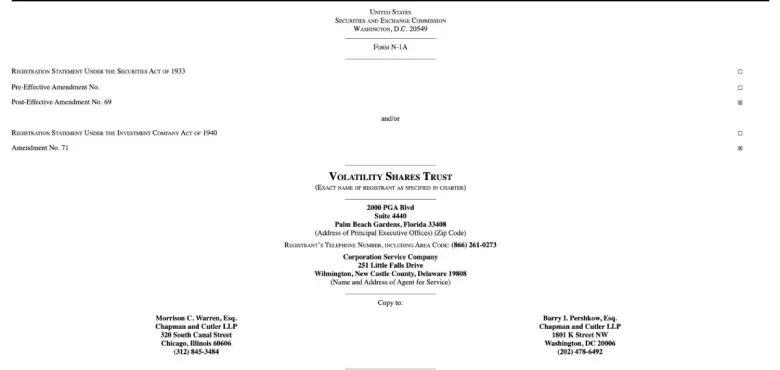

- Volatility Shares LLC will launch two Solana ETFs: SOLZ (standard exposure) and SOLT (2x leveraged exposure).

- Since late January 2024, a downsloping trendline has led to a steady correction trend in Solana price.

- The SOL price sustainability above 61.8% Fibonacci retracement level reflects a higher potential for a bullish reversal.

Solana Price Surge Following ETF Launch Announcement

According to a recent tweet from Bloomberg analyst Eric Balchunas, the Volatility Shares LLC is set to launch the first-ever Solana ETFs in the United States tomorrow. These funds will track Solana futures, with one offering a standard exposure (ticker: SOLZ) and the other providing 2x leveraged exposure (ticker: SOLT), mirroring products like BITO and BITX for Bitcoin futures. The ETFs are expected to stir investor interest, with expense ratios of 0.95% and 1.85%, respectively.

Volatility Shares LLC’s initiative is expected to pave the way for broader adoption of Solana-focused ETFs, which might soon be approved for public trading. These products cater to speculative investors looking to capitalize on Solana’s price movements, in a regulated environment.

If these new Solana products follow the success of Bitcoin ETFs, the native cryptocurrency, SOL, would witness an accelerated demand pressure.

Solana Price Teases Bullish Breakout From Crucial Resistance.

For over a week, the Solana price has been hovering sideways above the $116 horizontal level seeking support for a potential reversal. Coinciding with the 61.8% Fibonacci retracement level this support acted as a major accumulation zone for buyers to renew bullish momentum.

As the broader market correction eases, the Solana price has bounced from $112 low to $133, accounting for a 20% recovery. Currently, the coin price teases a bullish breakout from the downsloping resistance which carries the ongoing correction trendline.

A successful flip of this resistance into potential support will bolster buyers for a 35% upswing and challenge the next key resistance of $180.

On the contrary note, a breakdown below the $120 floor could invalidate the bullish thesis and drive an extended downfall below $100.

Also Read: Ripple’s Legal Uncertainty Clears as SEC Drops Appeal: What’s Next for XRP?