As per SoSoValue data, the Ethereum spot ETF market on August 1, 2024, saw substantial inflows and outflows among significant ETFs. Ethereum spot ETFs attracted combined net inflows of $26.74 million. The top inflows-getter on a single day was BlackRock’s ETF ETHA, taking in a whopping $ 89.6471 million. FETH, another ETF coming from Fidelity, got in $11.6982 million and is a viable addition to the list of total gainers. By comparison, Grayscale’s ETF ETHE saw a significant one-day outflow of $77.9509 million. It is hardly a bright beacon in this way since significant outflows from Grayscale have already followed $210.56 million on July 31. This compares with net outflows of 15,691 ETH (or $51.94 million) among nine US Ethereum ETFs on July 31, including the Beck family’s and WisdomTree Trust proposals from yesterday. The largest of the outflows was experienced by Grayscale, with 63,612 ETH ordered to be withdrawn at a value of $210.56 million; conversely, BlackRock’s inflow for their ETHA product was 36,061 ETH.

Contrasting inflows and outflows confirmed the dynamic nature of the Ethereum ETF market with back-to-back days. Confidence is high, and investors are eager to allocate funds based on the market’s direction and strategic opportunities in cryptocurrency.

Analyst’s Perspective:

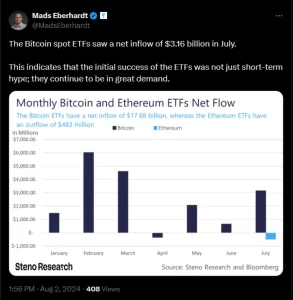

Steno Research’s lead analyst, Mads Eberhardt, speculated that the colossal capital withdrawals from Grayscale’s ETHE may gradually dissipate by week’s end, potentially functioning as an optimistic impetus for ETH valuations. Will Cai, the director of indices at Kaiko, underscored that ETH pricing would be reactive to deposits into immediate market instruments. At present, ETH exchanges hands at $3,168, declining 8.5% since the introduction of the exchange-traded funds on July 23, as indicated by TradingView metrics. Currently, a complex interplay of forces impacts the cryptocurrency landscape. While outflows signify bearish sentiment, subsiding selling pressure could portend a transition to stabilization or renewed rallying. Nonetheless, volatility is inevitable as competition intensifies between speculative and corporate adoption narratives.