The creators behind the Ethereum Layer 2 solution, Turbo Protocol, have made waves in the blockchain sector after introducing their new high-performance sidechain, which can process up to 400,000 transactions per second (TPS). Announced at the Blockchain Application Stanford Summit, this discovery solidifies Turbo Protocol as one of the frontrunners in a mission to create cost-effective and high-throughput blockchain solutions.

HAPPENING NOW: Turbo’s Founder, Aaron, takes the stage at @StanfordCrypto’s BASS event to talk about Turbo Protocol’s approach to bring parallel execution to Geth pic.twitter.com/nBcnQHRzl9

— Turbo Protocol (@TurboProtocol) August 6, 2024

At the New York City Summit, Turbo Protocol CEO Aaron Greenblatt performed a live demonstration of just how capable its blockchain is. This new Layer 2 network, with its innovative parallel transaction processing, enables applications to function without the need for expensive Ethereum gas. Unlike Ethereum’s inherent sequential processing, it allows for the simultaneous recording of many transactions.

Greenblatt opines “This is a game changer for the blockchain industry. Our technology will enable applications to scale like never before, breaking free from the constraints of traditional sequential transaction processing.”

With the Ethereum base layer processing 20–30 transactions per second, Solana with just over 1,000, and Visa at around 24,000, the mention of Turbo Protocol’s TPS (400k) should be seen as nothing short of a groundbreaking promise towards transformation for all parties involved.

Ethereum Dump and Whale Behaviour

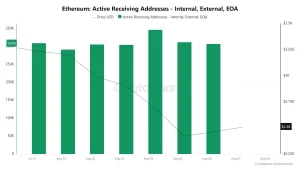

While the Ethereum network is honing its updates every second, the Ether token fell hostage to market turbulence after U.S. recession fears took over on Monday. In all this technological growth, the Ethereum price, currently $2,500, has seen a slight uptick. In the last 48 hours, its price rose by 4.49%. For more insights on where ETH might be headed next, check out ETH price predictions.

During this market slump, notable fluctuations have emerged. Six enormous wallet addresses belonging to the Nomad Bridge Exploiter group procured a considerable amount of Ether, totaling $340 million, according to on-chain analytics firm Lookonchain.

These whales purchased 144,071 ETH for an average price of $2,300 per ETH, indicating that they were investors willing to buy the dip with great optimism. Such large acquisitions under market pressure, on the one hand, illustrate additional risk and, on the other, suggest players of this size can create considerable imbalances in the cryptocurrency market. Large purchases during a dip indicate the enormous volatility and influence major traders have on cryptocurrency markets.

Market sentiment

Ethereum whales have taken advantage of this price dip in a manner akin to strategic market behavior, intending to influence sentiment in the broader market. Given that the price of Ethereum is approaching $2.5k per share, it appears that the investors, known as the ‘whales,’ are likely less concerned about the short-term actions of smaller investors and are instead choosing to invest (or hold) in the current market conditions. Despite the volatility, many large investors participated in the August 5th tumultuous plunge, signaling their commitment to long-term appreciation. Their resolve should hearten and give hope to casual investors, thereby swinging the atmosphere in favor of a bull run.