On Monday, March 17, the Ethereum price recorded a 2.7% increase to trade at $1,939. This upswing followed a broader market relief rally with Bitcoin teasing a bullish breakout from $85,000. However, the recent onchain activity on the ETH network shows a notable decline which maintains the risk of a potential breakdown. Is $1,500 Close?

Key Highlights:

- Over the past three months, the Ethereum price has plunged from $4,108 top to $1,928 current trading price, registering a loss of 54%.

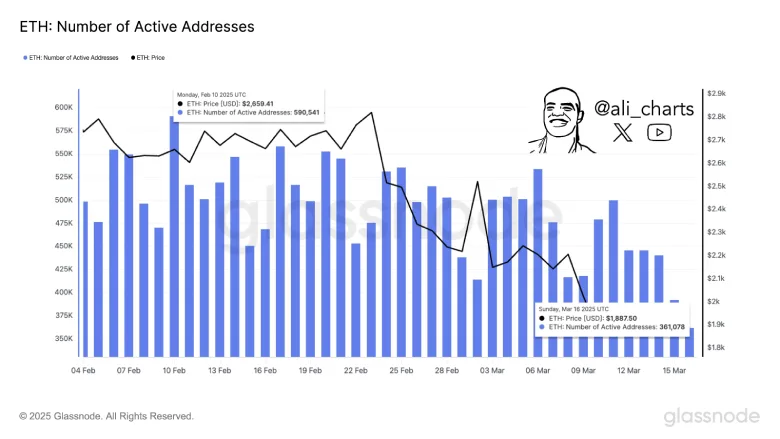

- Active addresses on Ethereum’s blockchain recently hit a low of 361,078, showing decreased network engagement.

- The lack of follow-up after the $2,000 breakdown could allow ETH buyers to counterattack.

ETH Faces Network Activity Decline Amid Price Struggles

Ethereum’s network activity has recently experienced a downturn, with active addresses on the blockchain reaching a low of 361,078 last weekend.

This marks a steep decline from the higher levels of activity observed earlier in the year, such as on Monday, February 10, 2025, when Ethereum recorded 590,541 active addresses with the price of ETH at $2,659.41.

This decline reflects a period of reduced engagement on the Ethereum network, signaling a decrease in participation and possibly a shift in market sentiment. If the trend continues, the crypto buyers will struggle to drive a sustained recovery and prolong the prevailing downtrend.

Ethereum Price Nearing $1,500 Breakdown

On March 10th, the Ethereum price gave a major breakdown below the psychological level of $2,000. This breakdown, along with a downsloping slope of daily EMAs (20, 50, 100, and 200) and a loss of 61.8% retracement level has strengthened the seller’s grip on this asset.

The aforementioned EMAs would act as dynamic resistance against price recovery, creating the path to least resistance on the downside. With sustained selling, the ETH price is likely to plunge 21% and hit $1,500 for another breakdown.

On the contrary, the coin price has traded sideways since the $2,000 breakdown, displaying market uncertainty with multiple neutral candles. The lack of follow-up on the downside indicates the buyers are preventing further downfall and could launch a counterattack.

Thus, the ETH buyers reclaiming $2,000 would mark the previous breakdown as a bear trap for a potential rebound.

Also Read: Canary Capital’s SUI ETF Filing Sparks 5% Surge; Is a Breakout Ahead?