On February 14th, Friday, the crypto market experienced a neutral stance as Bitcoin price showcased an overhead supply at 100k. While the selling pressure hinders recovery potential for most major altcoins, the Ethereum price displayed resilience and potential for recovery amid whale buying and minimum resistance to block its way.

Key Highlights:

- A downsloping trend drives the current correction trend in Ethereum, displaying a series of higher low formations.

- The ETH coin below daily 100 and 200 EMA hints broader market as bearish.

- Crypto analyst Ali highlights the absence of major resistance, suggesting ETH could rally to $3,000.

Crypto Analyst Sees No Major Resistance For ETH

In the past two weeks, the Ethereum price showcased a consolidation trend below the $2,800 resistance with a series of neutral candles. Despite the market uncertainty and prevailing correction, the ETH coin witnessed renewed interest from large investors.

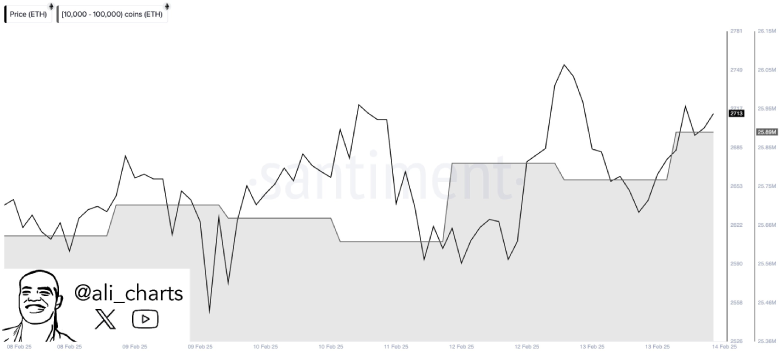

According to renowned crypto analyst Ali Martinez, whales have bought 280,000 Ethereum (ETH) in the last 72 hours of reporting. Typically, such accumulation in a lateral trend drives a bullish reversal and boosts market sentiment.

Ethereum’s price action has caught the attention of market analysts, with crypto trader Ali Martinez highlighting a key support zone between $2,380 and $2,460.

In a recent post, Ali pointed out that ETH has successfully held this demand zone, and with no significant supply barriers ahead, the asset could be poised for a rally towards the $3,000 mark. Backed by on-chain data, the analysis suggests a bullish outlook for Ethereum in the short term.

Bear Trap Sets Ethereum price for Sharp recovery

On February 4th, the Ethereum price gave a significant breakdown from the $2,800 support, paving the sellers for prolonged correction. The falling price, backed by a death crossover between the 50-and-200-day EMA, intensifies the bearish market sentiment.

However, the ETH price shows resilience above $2,550 support and shifted the price trajectory sideways. The market sellers’ failure to follow-up support breakdown hints at weakness in their conviction.

Thus, the buyers hold an opportunity to counterattack and reclaim the $2,800 level. If successful, the altcoin could chase for a higher level, such as $3,420, followed by $4,100.

Conversely, if sellers managed to defend overhead resistance, the current correction could plunge to $2,200.

Also Read: SEC Crypto Task Force Logs Meetings with Key Industry Stakeholders