On March 7th, Friday, the crypto market witnessed a slight slowdown in its prevailing correction momentum as U.S. President Trump signed the executive order for a Strategic Bitcoin Reserve. While the news did not trigger a notable surge in buying pressure, the ETH exchange activity witnessed a notable outflow, investors accumulation for a potential upswing. Is Ethereum price ready for a $3,000 breakdown?

Key Highlights:

- Since mid-December 2024, a downsloping trendline has been carrying the current correction trend.

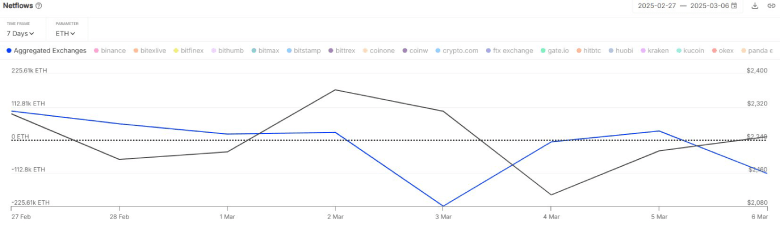

- Over $500 million in Ethereum was withdrawn from exchanges this week, signaling investor accumulation.

- Ethereum price sustainability above $2,150 is crucial for a renewed recovery trend in March.

Ethereum Exchange Outflows Signal Bullish Sentiment

According to the onchain analytics platform IntoTheBlock, over $500 million worth of Ethereum (ETH) was withdrawn from exchanges this week. The move signals strong accumulation among ETH traders, hinting at a potential bullish sentiment in the market.

Exchange outflows of this scale often indicate that investors are moving their ETH to cold storage or staking platforms, reducing immediate sell pressure. Despite a significant market correction in the last two months, this accumulation trend signals a buy-the-dip sentiment among investors, typically spotted at an established uptrend.

ETH Price at Crucial Support, Eyes Breakout to $3,000

On March 3rd, Monday, the Ethereum price witnessed a significant sell-off and plunged below a long-coming support trendline. Since June 2022, this dynamic trendline has bolstered a sustained uptrend for ETH buyers, and therefore, the bearish breakdown was expected to intensify selling pressure.

However, the coin price has been wavering sideways for the past four days, indicating a lack of follow-up on the downside. The long-tail rejection candle in the daily chart accentuates the intact demand pressure and buyer’s conviction to defend this floor.

By press time, the Ethereum price traded at $2,204, with an upside potential of 15% to challenge a downsloping trendline. A successful flip of this dynamic resistance to bullish support could drive renewed recovery to $3,000.

Also Read: WazirX Faces FIU Investigation Amid Fraud Allegations & Security Breaches