The Ethereum Foundation recently sold off 100 ETH for approximately 402,473 DAI. This is the latest in the series of transaction that the Foundation has made in the past week. The Foundation has offloaded a total of 200 ETH for 776.8K DAI in the past seven days and these transactions have sparked discussion about their strategy and the community is wondering, how will this move affect the price of the token.

A Pattern of Ethereum Sales in 2024

The Foundation in this year has sold off about 4,466 ETH worth $12.21 million, averaging a price of $2,822 per ETH. These repeated sales have raised questions amongst the community regarding the Foundation’s intentions. Some speculate that this could be for operational funding, while the others believe that it may signal caution regarding market trends.

Has This Happened Before?

The Ethereum Foundation has previously pulled off same move where they have sold substantial amounts of ETH, which has caused short term price dips for the token. However, many analyst believe that ETH’s long-term prospects remain strong. According to analysts, Ethereum price prediction indicate the that the price for ETH could range from $3,000 to $5,000 in the near term.

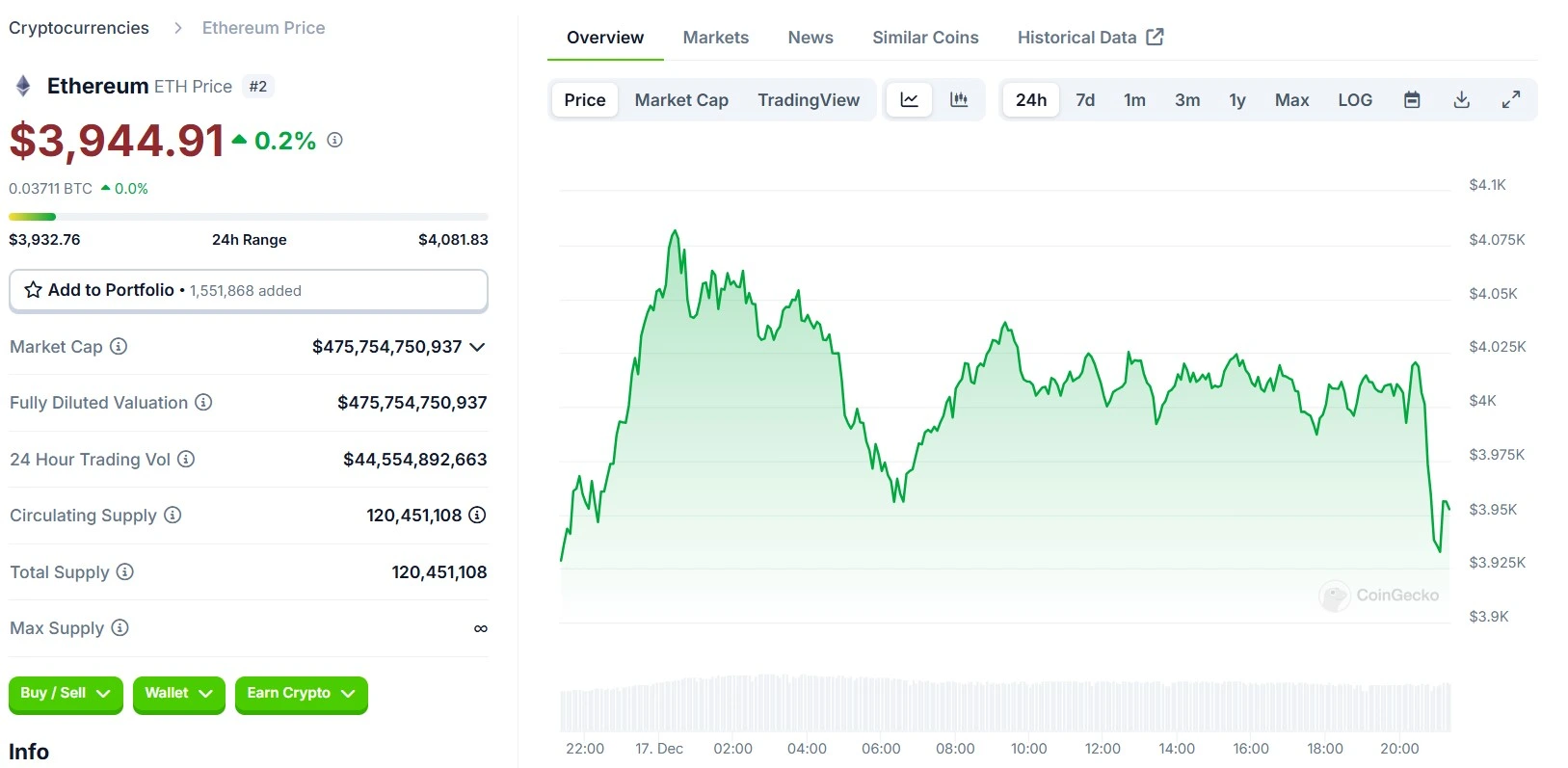

At press time, the price of the ETH token stands at $3,944.91 with a 0.2% surge in the last 24 hours.

While these sales could cause temporary volatility, analyst note that the ETH remains fundamentally strong. Investors are closely monitoring the activities carried out by the foundation for further signs of trend changes. As of now, the Ethereum Foundation’s continued ETH offloading remains a point of focus for the market watchers.

Also Read: FTX To Initiate Initial Distribution by March 2025