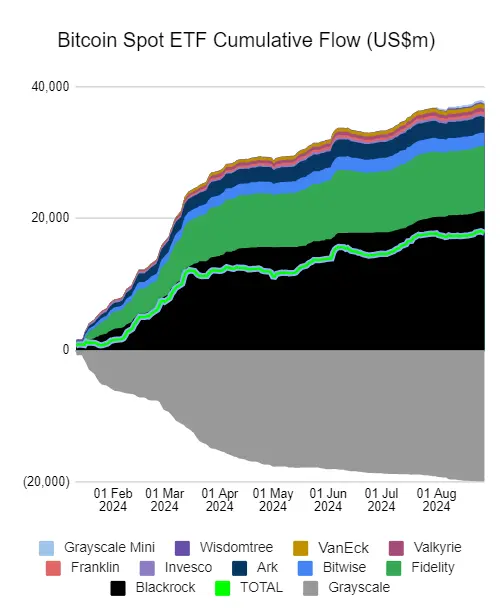

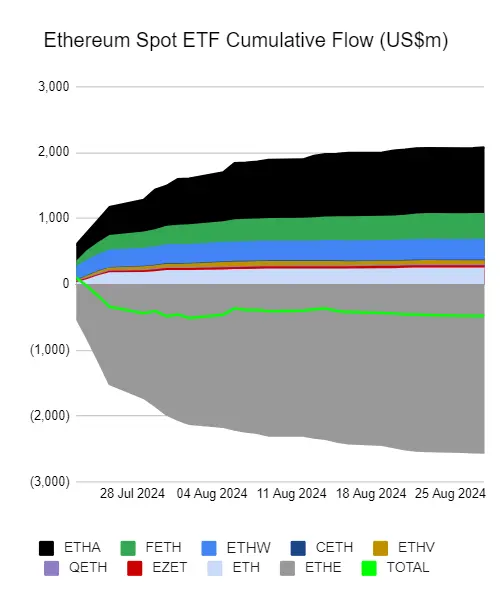

Sentiments in Spot Bitcoin ETF and Spot Ether ETF have changed. Bitcoin ETFs reported net outflow for the second consecutive day, while Ether ETFs saw net inflow for the first time after nine consecutive days of outflow.

BlackRock published its numbers for Ether but failed to highlight the same for Bitcoin ETF. Bitcoin ETFs banked a net outflow of $105.3 million, and Ether ETFs experienced a net inflow of $5.9 million as of August 28, 2024.

Bitcoin ETFs are drained from every possible corner. Not just Grayscale but Fidelity, Bitwise, and Ark bleeded too. FBTC, BITB, and ARKB reported net outflows of $10.4 million, $8.7 million, and $59.3 million, respectively. Notably, only a few issuers stood out, seeing the funds coming in.

Source: https://farside.co.uk/btc/

A similar story unfolded for ETH ETF, except it saw inward movement from every issuer. Grayscale stood as an outlier with a negative flow of $3.8 million. ETHA and FETH reported net inflows of $8.4 million and $1.3 million, applicable in the same order.

Source: https://farside.co.uk/eth/

These sentiments are reflected in the token values, too. BTC, for one, is up by 1.62% in the last 24 hours. ETH, on the other hand, has outperformed the flagship crypto with a surge of 4.59% during the same time window. Bitcoin tokens are down to $59,622.28, and Ether is exchanging hands at $2,549.36 while the article is being drafted.

It is right to assume that Spot Bitcoin ETFs had the chance to report a better number if BlackRock and others had something to show. IBIT didn’t report any figures yesterday, and the column was left blank.

The total net inflow for Spot Bitcoin ETF is $17,850 million, and the total net outflow for Spot Ether ETF is $475.7 million. BlackRock is leading the way with over $1 billion in positive flows for Spot Ether ETF. It is also the leader in the Bitcoin segment, with more than $20 billion at the moment.

All eyes are on the movement of token prices. September is reported to be a crucial month for the crypto market. To a large extent, that could be a pivotal moment when investors begin injecting liquidity into the ecosystem. Benefits will span across the ETF sector.

That said, more cryptos are soon attempting to float their regulated investment products in the market. However, the US SEC has hinted at taking more precautionary measures to approve upcoming crypto ETFs. SOL and XRP are at the top of the list, even though the agency has not officially spoken about them.

Bitcoin and Ether ETFs have enabled investors of every background to try crypto trading without having to store their funds directly in their wallets. More crypto ETFs will not only help them diversify their options but also strengthen the adoption of cryptocurrencies in the market.