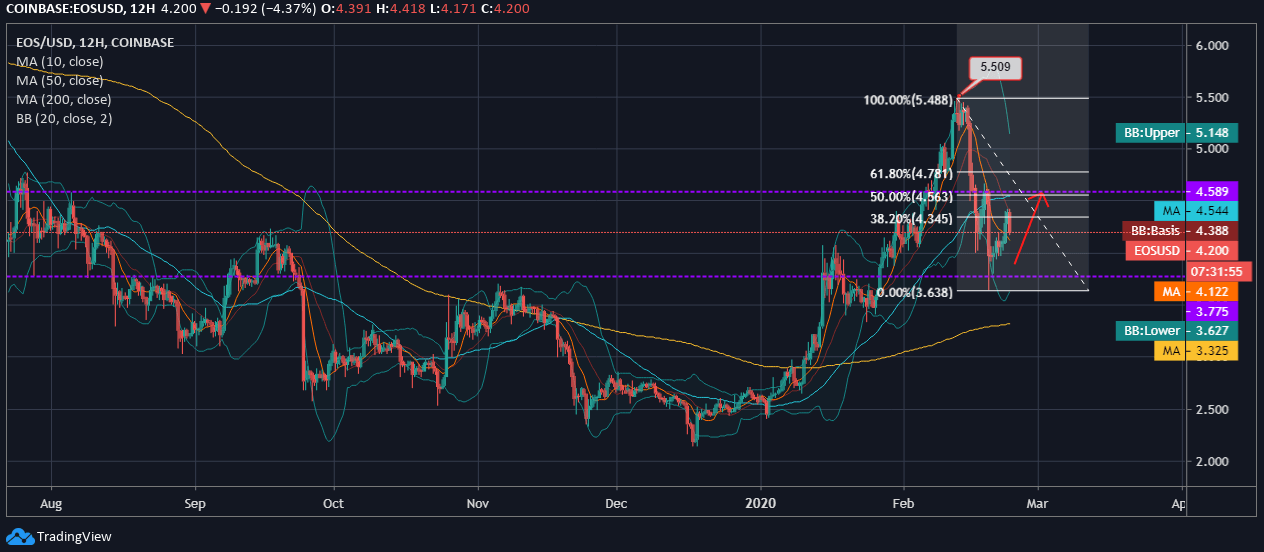

- EOS, at the time of penning down this analysis, was trading at $4.2 and was seen rising from the support at $3.5 and $3.7

- Currently, EOS/USD spikes above the buying zone as it hits beyond 38.20% Fib Retracement level

- The currency retains immediate short-term support from 10-day MA followed by 200-day MA, exposed to volatility in the upcoming days

- EOS price trend against the US Dollar is seen forming a narrow rising trend, thereby holding a bullish crossover

EOS draws an overall falling trend as observed from the second week of the ongoing month, just when BTC had dipped below $10k for the first time after mounting beyond. If the price approaches $3.5 to $3.7 price zone, it will be a buy situation.

EOS Price Analysis

Analyzing the 12-hourly movement of EOS/USD on Coinbase, we see that the coin took an amazing pace since the start of the ongoing year after a sheer despairing trade in the latter half of the previous month.

Around the mid of January 2020, the coin experienced a “golden crossover” when the price mounted as high as $5.5, marking a fresh 7-month high.

However, its been five days now since Bitcoin is trading below $10,000, and so are the altcoins eventually turning red and losing the momentum.

Simultaneously, if we compare the 4-hourly time frame, we see that EOS coin is holding a narrow rising trend within a bearish crossover over the past week.

Alongside, the technical indicators appear moderately bullish as the MACD line of EOS cuts the signal line from below.

The RSI of EOS coin is at 48.20 and exhibits no trading extremities at present. To know realistic EOS price prediction visit our exclusive post on EOS Predictions.