The cryptocurrency market experienced a 9% surge following President Donald Trump’s call to create reserves using cryptocurrencies, including Ripple (XRP), Solana (SOL), and Cardano (ADA), Bitcoin (BTC) and Ethereum (ETH). According to data from CoinGecko, the total market value of cryptocurrencies rebounded by 9% to $3.25 trillion after Trump’s announcement.

Bitcoin , Altcoins Surge Amid Donald Trump’s Reserve Promise

Yesterday, Trump reaffirmed his pro-crypto stance with a post on X (formerly Twitter), stating, “A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration. That’s why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA.”

Among the cryptocurrencies mentioned, Cardano (ADA) saw a significant rise of 73% after Trump’s remark, reaching a high of $1.148. As of now, ADA is trading at $1.10.

Ripple (XRP) hit a high of $2.9641 and is currently trading at $2.87. The 24-hour market volume of XRP surged by 452.65%, reaching $18.18 billion. Meanwhile, Solana (SOL) surged to $174.42.

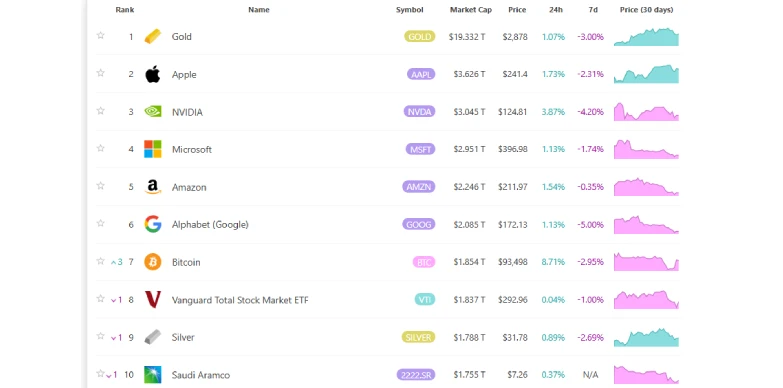

In addition, the optimism surrounding a strategic crypto reserve has fueled a surge in Bitcoin, which is now trading at $93,359.49 after an 8% increase. Bitcoin has reclaimed its spot among the top 10 assets, with a market cap of $1.854 trillion. This surge has allowed Bitcoin to surpass the Vanguard Total Stock Market ETF, silver, and Saudi Aramco, securing its 7th position.

Trump’s timely remarks come at a moment when the cryptocurrency market was facing uncertainty. Recent dips had left traders questioning what the future held for the sector. The uncertainty persisted despite relief from the U.S. Securities and Exchange Commission (SEC), which dropped litigations against several crypto firms, including Coinbase, Robinhood, and Uniswap. A significant factor in the recent downturn was attributed to Trump’s tariff war with other countries, along with a global market response that strengthened the U.S. dollar.

Also Read: Bitcoin Boom or Bust? Market Hinges on U.S. Reserve Decision