The Federal Reserve announced its decision to cut interest rates on August 21 in its July Federal Open Market Committee (FOMC) meeting. Federal Reserve Chair Jerome Powell took to the podium at the Jackson Hole Economic Symposium and said, “The timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

While the interest rates were unchanged during the previous FOMC meetings, a rate cut is likely to take place at the September 18th meeting. The impending rate cut has put the crypto market in a tight spot.

Bitcoin:

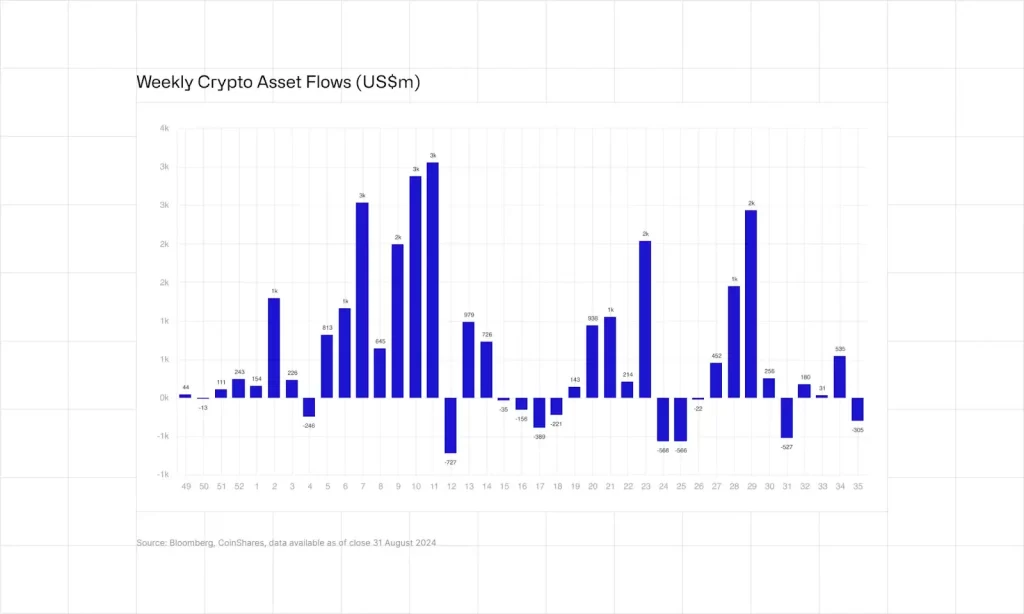

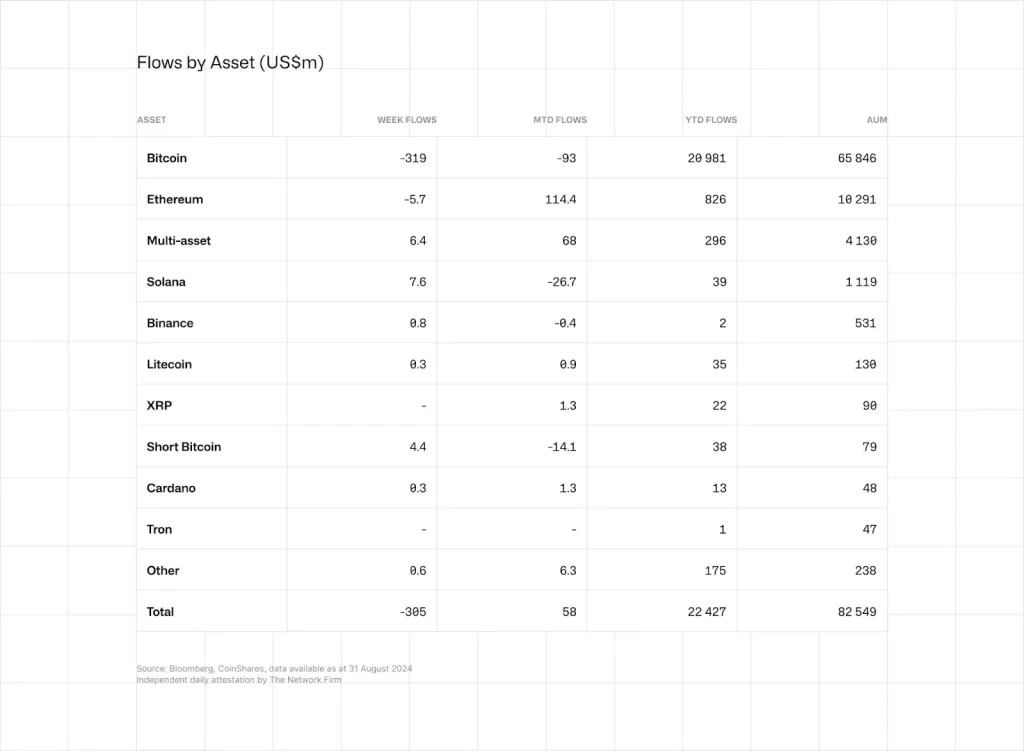

According to CoinShares’ report, digital assets Investment products saw a net outflow of $305M last week, with Bitcoin seeing an outflow of $319M.

Source: Bloomberg and CoinShares

Short Bitcoin products like futures and contracts, on the other hand, saw a second consecutive week of inflows worth $4.4M, the most significant inflow since March. The market sentiment for Bitcoin has plummeted further as investors are second-guessing its position as a hedge against the potential slump in the crypto landscape.

Source: Bloomberg and CoinShares

Ethereum:

The total outflow for Ethereum stands at $5.7M, hinting that investor interest in Ethereum is also cooling down. The trading volume for the asset has also taken a blow due to the decline in demand. The trading volume has reduced to 15% of what was seen during the week of the U.S. ETF launch. The anticipation around the rate cut has demotivated investor sentiment, as they are reassessing the risk/reward ratio for their Ethereum holdings. ETH is trading at $2,519.93, with Ethereum price predictions warning for further drops in the asset’s price.

Solana:

Solana, in contrast to the top cryptos, has witnessed an inflow amount worth $7.6M, signaling a rise in investor sentiment. This depicts a growing perception among investors that Solana holds promise as an investment due to its growing network and robust technology.

Blockchain Equities:

Investors seem to find value in blockchain equities. Blockchain equities, especially those tied to Bitcoin mining, have seen $11M in inflows.

Market Sentiment:

As per data, investors are more invested in blockchain equities, with the decision to cut interest rates coming closer by the day. Investors are mostly trying to implement risk management strategies, which is why they are choosing to invest in blockchain equities rather than assets. The market is in a frenzy amid the perceived threat of a rate cut. So far, September does not bode well for crypto, as the likelihood of a 50-basis-point rate cut has been reduced to a 25-basis-point rate cut. As the crypto market thrives on liquidity, a 25-bps rate cut would only inject a little liquidity, as hoped by the investors early on. This is why volatility has increased for all the major cryptocurrencies, with a distinct drop in the open interest rate, especially for Bitcoin. Traders are likely adjusting their positions in the market as a response to the less accommodative monetary policy. Many investors buy assets and sell them after a rise in rate cuts to make more profits. However, a more minor rate cut would mean lesser profit, an incentive for investors to close their positions in the market.

It is hard to foretell how the crypto market will react to the September 18 Fed decision, as the entire market is on edge. Nevertheless, the final rate cut announcement will indeed have a pivotal role in restructuring the market, especially in the fourth quarter.