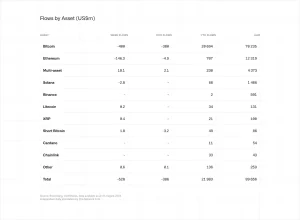

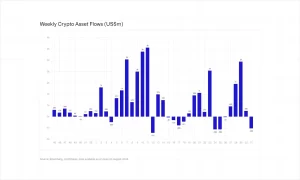

Global cryptocurrency investment offered by titans of the asset management industry, including Ark Invest, Bitwise, BlackRock, Fidelity, Grayscale, ProShares, and 21Shares, posted net outflows for the first time in four weeks, totaling $528 million, as per CoinShares’ most recent report. The products witnessed withdrawals following weeks of accrued gains as worries over the recession and geopolitical instability overwhelmed initial optimism from bullish institutional participation. Commenting on the price correction, James Butterfill, the Head of Research at CoinShares, quoted, “The price correction from Friday’s close saw $10 billion wiped off total ETP AUM.” After five straight weeks of inflows, Bitcoin ETFs were the worst performers, leading net outflows totaling $400 million. In contrast, short Bitcoin funds also recorded their first major net inflows since June, reaching $1.8 million.

U.S. spot Bitcoin ETPs accounted for the lion’s share of that global outflow, coming in at $80.6 million as a massive net redemption on Friday ($237.4mn) overrode earlier-week net creations. Ethereum investment products also saw significant outflows, totaling $146 million globally (U.S. spot Ethereum ETFs accounted for most of these with output of $169.4m). All the same, newly launched Ethereum ETFs received a total of $433.6 million in net inflows compared to outflows worth $603 million for Grayscale’s flagship ETHE fund, which tends to have higher fees. U.S. funds posted the largest losses in the region, with $531 million in net outflows; Hong Kong reported outflows of $27 million, and Germany reported $12 million in outflows. Switzerland and Canada were the only countries that saw BTC net inflow, with $28 million and $17 million, respectively, showing some entities used lower prices to buy the assets. In reflecting the broader tech-related ETF trends, crypto-related equities also saw an outflow of $18 million.

Bitcoin price dropped to below $50,000, and Ethereum erased all gains as the crypto market lost steam heading into last weekend. At the time of writing, Bitcoin is trading at around $50,797, which shows a 16.54% drop in the previous 24 hours and an almost similar -26.91% loss every week. Ethereum is trading at $2,305, down 6.51% over the last day and down by 7.7% this week. Further, the crypto market encountered $1.029 billion in total liquidations in the previous 24 hours.

Will the Fed’s anticipated slash in interest rates be able to resuscitate this plunge, or are we going around and down on these crypto markets? That continues to be an open question as the market discovers and re-discovers that volatility is its only true second nature. The macroeconomic backdrop and tensions within the geopolitical landscape may continue to evolve in the coming days or weeks. That leaves crypto proponents wondering if this is a mild pullback or the beginning of another crypto winter.