On February 21st, Friday, the U.S. market suffered heavy losses as the benchmark Wall Street index NASDAQ plunged 1.8%, and the blue-chip S&P 500 index reported a 1.8% loss. The broader market selling pressure plunged Coinbase Stock price 6.5% to $239, signaling a prolonged correction before buyers could renew the prevailing uptrend.

Key Highlights:

- Since December 2024, the Coinbase stock price has resonated within two downsloping trendlines, indicating bull flag formation.

- The COIN price correction is poised for a 10% slide before a $400 rally.

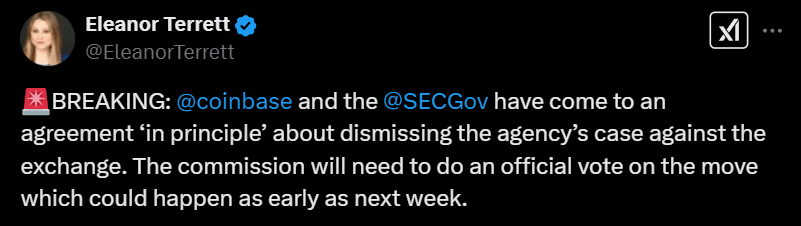

- On Friday, Coinbase and the SEC reached an agreement “in principle” to dismiss the case.

Coinbase Clears Legal Hurdle as SEC Agrees to Case Dismissal

The legal battle between Coinbase and the SEC has been a focal point of regulatory scrutiny in the crypto industry. The case involved allegations that Coinbase operated as an unregistered securities exchange.

However, on February 21st, Coinbase and the U.S. Securities and Exchange Commission (SEC) reached an agreement “in principle” to dismiss the regulatory agency’s case against the cryptocurrency exchange.

Fox Business journalist Eleanor Terrett broke the news via social media, stating that while the agreement has been reached, the SEC Commission must still conduct an official vote on the matter. This vote could take place as early as next week, determining the final outcome of the case.

Coinbase Stock Price Nearing Major Support Test

Amid the broader market consolidation, the Coinbase Stock price shows a significant correction from a $302 high to the $238 current trading volume, registering a loss of 21%. This reversal in the daily chart shows a bear cycle with the downsloping channel of the bull flag pattern.

The chart pattern is characterized by a sharp uptrend displaying the buyer’s dominance in the current market, followed by a temporary pullback to recuperate the exhausted momentum. If the pattern holds true, the COIN price could tumble another 10% down to $210 and retest the flag pattern.

Historically, a reversal from the support trendline has bolstered buyers with a bullish upswing of 20-30% before challenging the overhead resistance. An upside breakout from flag resistance will signal the end of the correction trend and accelerate the buying momentum for a potential target of $400.

Also Read: ByBit Revolutionizes Crypto Transparency with Real-Time Liquidation Data Disclosure