Chainlink, or $LINK, registered an impressive rally of 61.65% in 2024 Q3. The coin has garnered global attention, and investors are eyeing a new all-time high.

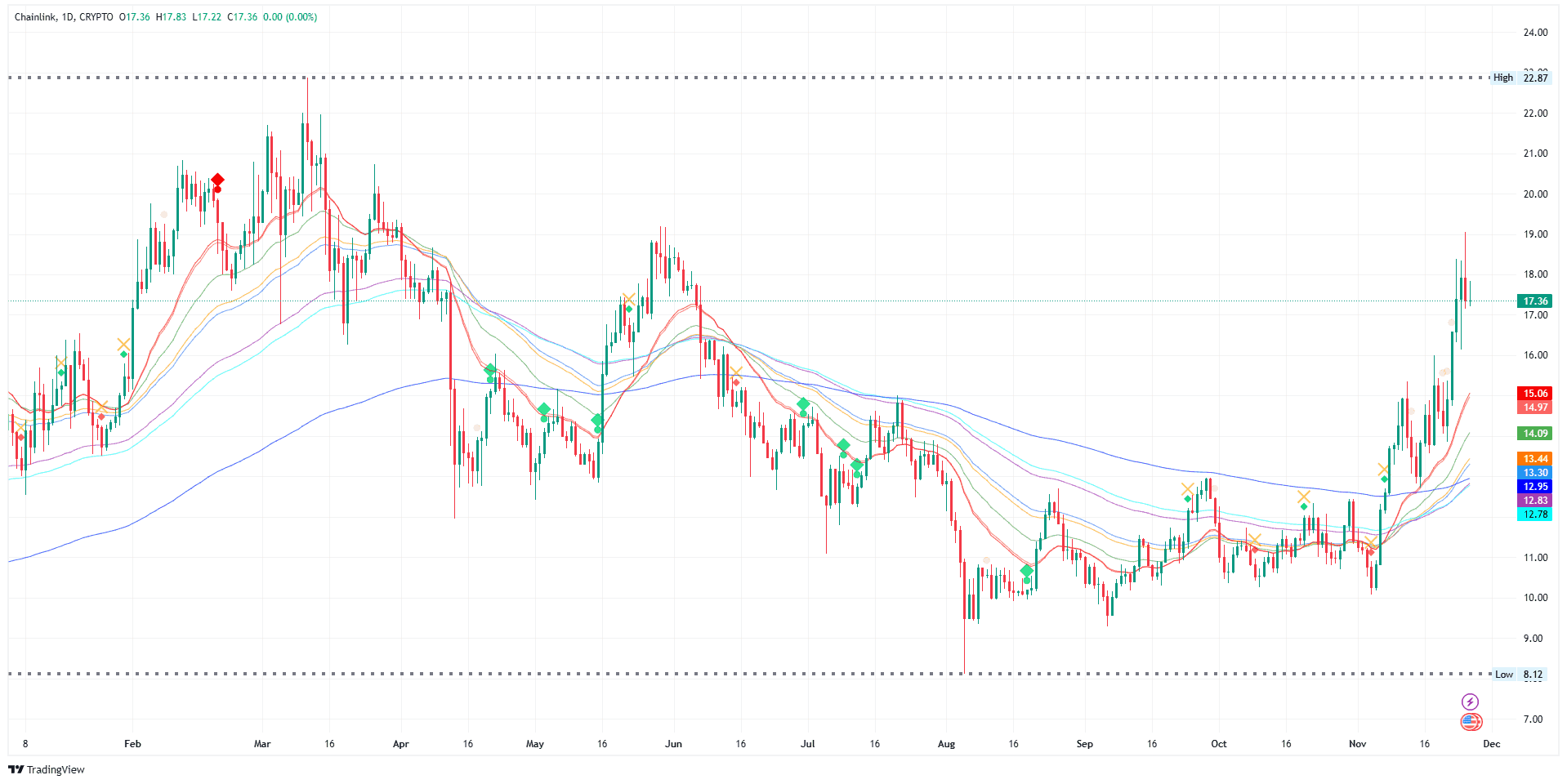

$LINK currently trades at 17.52 dollars, with a 3% dip in the past 24 hours. Its weekly performance shows a contrasting 17% surge.

Due to its unmatched services and low downtime, Chainlink is the go-to decentralized Oracle solution for projects. Another primary reason behind its rally is the increased adoption of DeFi and smart contracts.

The Oracle solution offers an impeccable infrastructure for blockchain apps. The platform enables tamper-proof and reliable data feeds to dApps via its Oracle network. The use case has positioned Chainlink as a unique venture, especially in the insurance, supply chain management, and finance industries.

Most DeFi projects in the market rely on Chainlink for external data, strengthening its position. The surging number of projects is also pushing $LINK towards a strong upward trend.

However, experts closely monitor key resistance labels that can decide how the token will act. The barrier at 22 dollars can stop $LINK from hitting its all-time high. The price level is a prominent benchmark for many Chainlink holders as their cost basis.

According to the latest Chainlink crypto price prediction 2025, a breakthrough past 22 dollars will push $LINK to 30 dollars. It can potentially even help the token reach a new ATH. Analysts foresee 22 dollars to 26 dollars to be the most critical price zone for the coin.

Since most investors bought the token in this price band, it can trigger either resistance or support in future movements.

Partnerships with names like SWIFT and Google are another factor helping Chainlink’s case. The Oracle solution demonstrates its real-world value among market leaders from different domains.

At the same time, its institutional popularity is also surging, with big players recognizing the need for decentralized oracle networks. The influx of huge capital merged with Chainlink’s growing use cases, can spell unforeseen growth for the platform.