On Monday, March 17th, the Cardano price showed a slight uptick of 3.15% to trade at $0.72. The bullish upswing likely followed a broader market relief rally as Bitcoin teased a breakout from the $85,000 mark. However, the latest onchain highlights a significant cashout from whale investors, hinting at the risk of the potential drop in ADA coin. Is $1 still far?

Key Highlights:

- The Cardano price correction is likely to extend 16% down to test the crucial bottom support of the triangle pattern.

- A bearish crossover between the 20-and-50-day EMA slope could extend consolidation above $0.6.

- Onchain data reveals 100M ADA sold by whales, signaling potential downside risk.

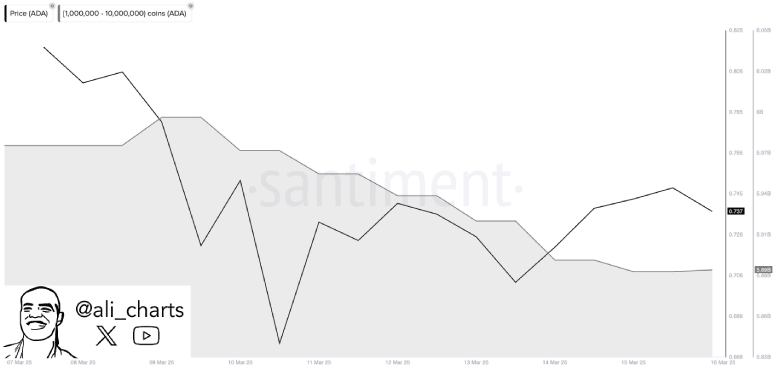

Cardano Whales Offload 100M ADA

Since last week, the Cardano price has traded sideways around the $0.7 level, forming a series of neutral candles. While the consolidation indicates no clear dominance from buyers or sellers, the onchain is a notable change in large holders activity.

In a tweet, crypto analyst Ali Martinez highlighted that Cardano (ADA) whales have reportedly offloaded more than 100 million ADA tokens in the past week. The large-scale liquidation indicates a shift in whale behavior that could impact ADA’s short-term price trajectory.

Historically, such sell-offs signal potential profit-taking or a lack of confidence in immediate price action.

Cardano Price Analysis: Key Levels To Watch In Current Correction

Cardano price analysis of the daily chart shows a sharp reversal from $1.17 to $0.72 — a 38.6% — loss over the past two weeks. The downfall breaks below the daily EMAs (20, 50, 100, and 200), strengthening the seller’s grip over this asset.

With the aforementioned whale selling and EMAs breakdown, the ADA price is poised for a 16% fall to hit the lower boundary of the triangle pattern. Since mid-November 2, the coin price has been resonating with the two converging trendlines of the triangle pattern. If the bottom support breaks, the Cardano coin would extend correction below $0.5.

Alternatively, the aforementioned trendline has acted as a major accumulation zone for ADA buyers since mid-November 2024. The previous bull cycle from this support has uplifted the asset from a range of 50% to 155%.

Thus, if the price trajectory shows renewed buying pressure at around the $0.6 floor, a bullish reversal could follow in the near future.

Also Read: Canary Capital’s SUI ETF Filing Sparks 5% Surge; Is a Breakout Ahead?