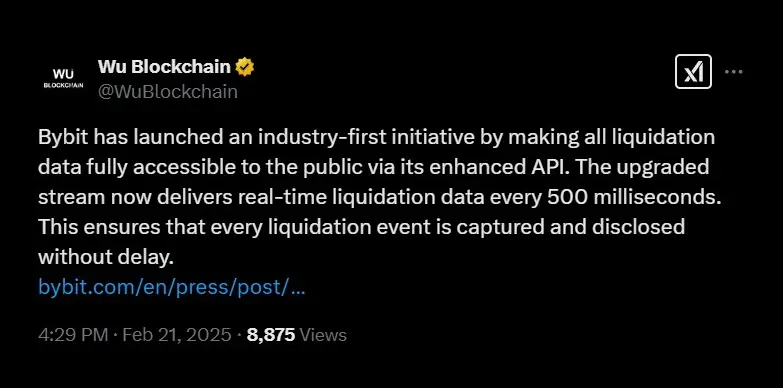

ByBit has made a significant move by launching an initiative that fully discloses all liquidation data through an upgraded API. Announced through a press release on February 21, 2025, this new feature allows users to access real-time liquidation data every 500 milliseconds via, the WebSocket topic “All Liquidations,” significantly improving upon the previous limit of one message per second per transaction.

This development positions ByBit as a leader in proving transparency and catering to the growing demand for reliable market data among institutional investors and traders.

The Importance of Transparency

Ben Zhou, co-founder and CEO of ByBit, emphasized the importance of transparency in the crypto space. He stated, ” The real spirit of crypto is transparency,” highlighting that this move responds directly to community calls for more openness.

The upgraded API will provide traders with comprehensive insights into market dynamics, enabling them to make informed decisions based on accurate and timely information.

Addressing Gaps In Liquidation Reports

As per the press release, this initiative addresses significant gaps in the reporting of liquidation events, which have historically been underreported due to API limitations across various exchanges.

Zhou pointed out that previous figures did not capture the true scale of market activity, with estimates suggesting that recent liquidations could be as high as $10 billion, far exceeding the $2 billion reported by other platforms like Coinglass.

Empowering Traders with Real-Time Data

ByBit’s commitment to full disclosure not only enhances market clarity by it also gives traders a chance to refine their risk management strategies. With access to real-time data, investors can better identify support and resistance levels and anticipate market volatility.

Industry Impact and Adoption

The impact of ByBit’s transparency initiative is already being felt across the industry. Coinglass, a leading cryptocurrency analytics platform, has integrated ByBit’s liquidation data into its interferance, allowing users to visualize market events with utmost accuracy.

As institutional interest in cryptocurrency continues to increase, ByBit’s proactive approach sets a new standard for transparency and openness in the digital asset market. This move is bound to bring in greater confidence among hedge funds and trading firms looking for a reliable partner in this space.

Also Read: Kanye West Set to Release YZY Memecoin Amid Market Skepticism