Ben Zhou, CEO of Bybit, has announced launch of lazarusbounty.com, a site offering up to $140 million to ethical cyber security experts who can help recover $1.4 billion in stolen cryptocurrency. The theft, suspected to be carried out by North Korea’s Lazarus Group, coccured on February 21, 2025 when an Ethereum (ETH) multi-sig cold wallet was manipulated. Attackers then gained control of the wallet and transferred holdings into unidentified address.

The Lazarus Group: A Threat to Cryptocurrency Security

The Lazarus Group is well-known for its cybercriminal activities on behalf of North Korean government. Whatever is stolen from these hacks is used to fund North Korea’s nuclear weapons program, making efforts to combat their activities crucial for international safety and stability.

Bybit’s Bounty Structure

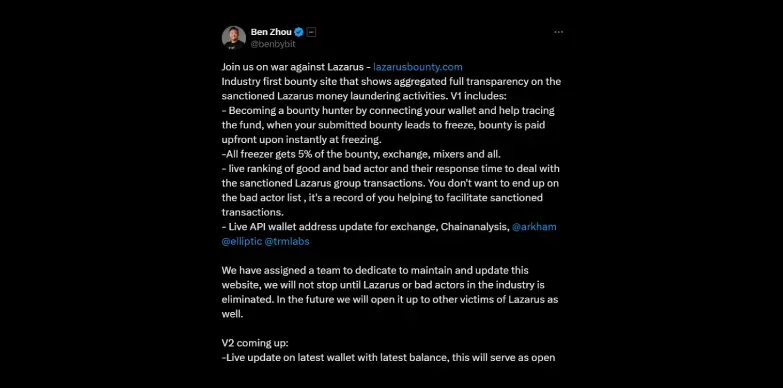

In response to the Bybit theft, the exchange is offering a reward of 10% of any recovered funds. The bounty site aims to bring transparency to the sanctioned Lazarus Group’s money laundering activities, allowing bounty hunters to connect their wallet and trace funds.

Rewards are paid instantly upon freezing the funds, with freezers receiving 5% of the bounty. The site also features a live ranking of good and bad actors based on their response time in dealing with sanctioned Lazarus Group transactions.

He even announced that his team will relentlessly maintain and update the website to track and expose Lazarus’ activities, with plans to expand it to support other victims. The upcoming version 2 of the website will feature live updates on Lazarus’ wallet balances, creating an open bounty for bounty hunters to track and claim responsibility for monitoring specific wallets.

Collaborative Actions

Bybit has praised industry groups for their assistance in tracing, blocking and recovering some of the stolen funds.

Bybit’s proactive measures and collaboration with the cybersecurity community indicates its commitment to recovering the stolen funds and combating illegal activities in the crypto space.

Also Read: Bitcoin Boom or Bust? Market Hinges on U.S. Reserve Decision