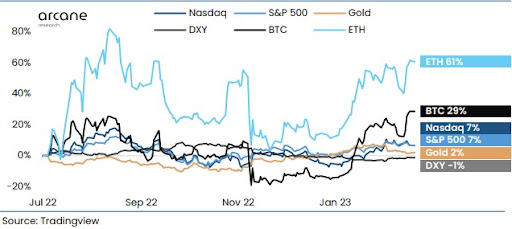

Arcane Research published a report on February 21 regarding the performance of cryptocurrencies as digital assets. In this report, Bendik Schei and Vetle Lunde claimed that crypto had outperformed other assets since July 2022. Moreover, the crypto uptrend, especially Bitcoin, was uncorrelated to the broader financial market in the second week of February.

Along with Bitcoin, Ethereum outperformed other digital assets, especially after the horrendous days of November when FTX announced their liquidity crisis in the market and most cryptocurrencies suddenly fell to a yearly low.

It is true that since July 2022, US Equities, especially Dow Jones, remained flat, but Bitcoin fell from $30K to $16K. In February 2023, Bitcoin is trading around$ 25K, which suggests recovery from the yearly low within a few months. The sentiment and price analysis suggest a continuation of this uptrend in the next few months. Indeed, it can be the right time to invest in the long term.

The last 30 days’ Bitcoin price action suggests a consolidation within a range of $25K and $20K, which might form a higher high in the long-term chart at the end of this year. Ethereum also recovered from $1200 to $1600 in the last two months, and now it has been consolidating since January. However, based on the ETH predictions, it holds the potential to rise, and ETH price will go up above $2k by the end of this year.

Arcane research report claimed that the rally had been driven by internal forces, which does not reflect the performance of broader financial markets. Experts think it will encourage external demand for BTC as a portfolio diversion, especially from retail investors.

Overall, if crypto performs better than stock markets in 2023, then many new investors will enter to join the uptrend. As a result, the price of cryptocurrencies will boost because of excessive demand.