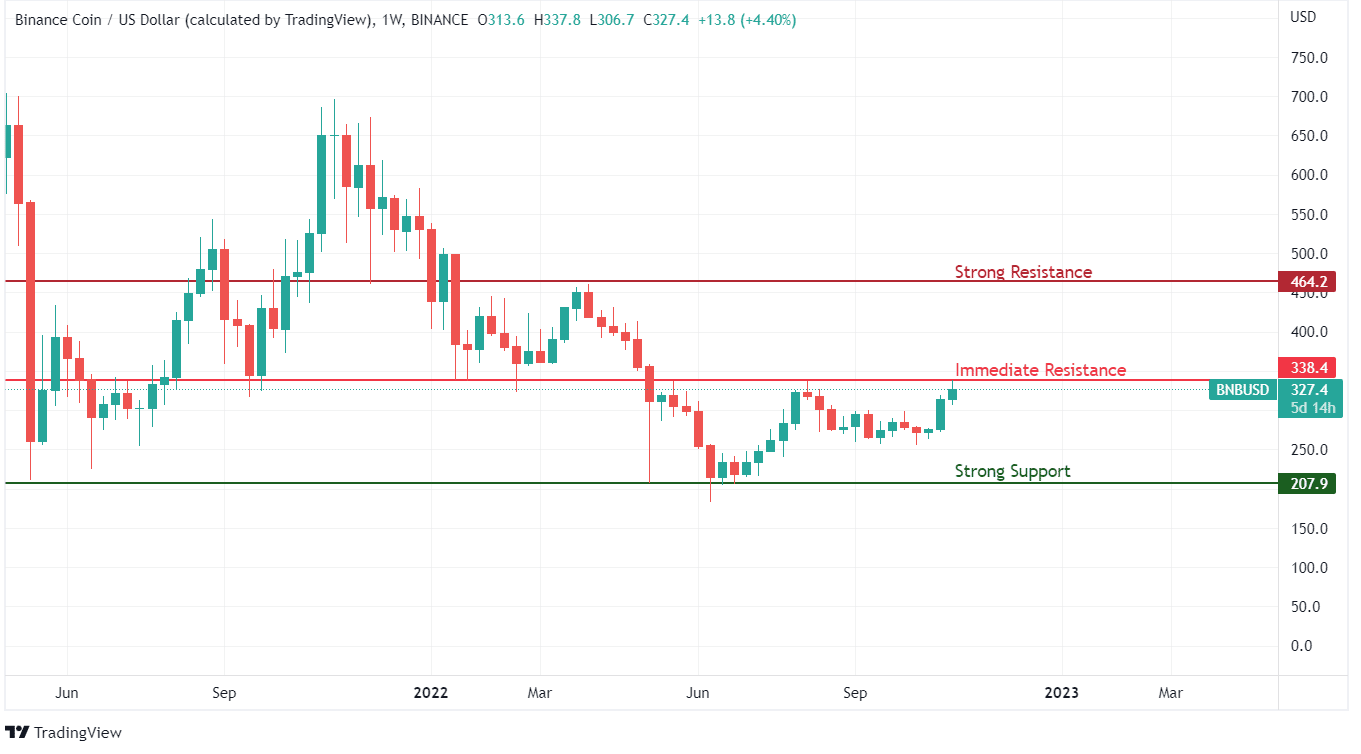

BNB, as a token, reached a peak value near $700 twice in 2021. While the possibility of repeating similar levels in 2022 is grim, the outlook is slowly picking up pace, and analyst expectations of reaching $400 are quite high.

The market capitalization is changing, but crypto rankings remain at similar levels because of positive movements in the top-ranking cryptocurrencies. There was a time indicating the beginning of Crypto winter, but the current time sure oozes the sense of a bearish trend coming to an end. Price action above $330 would bring BNB back into positive territory, similar to what we witnessed after the ending of the profit booking in July 2021.

BNB is gradually moving towards previous resistance levels that it left unchecked. The price action at resistance levels is behaving shakily, but the outlook has a strong possibility of turning positive. Both the moving averages have already been secured, and the movement for most cryptocurrencies is shifting toward a bull run.

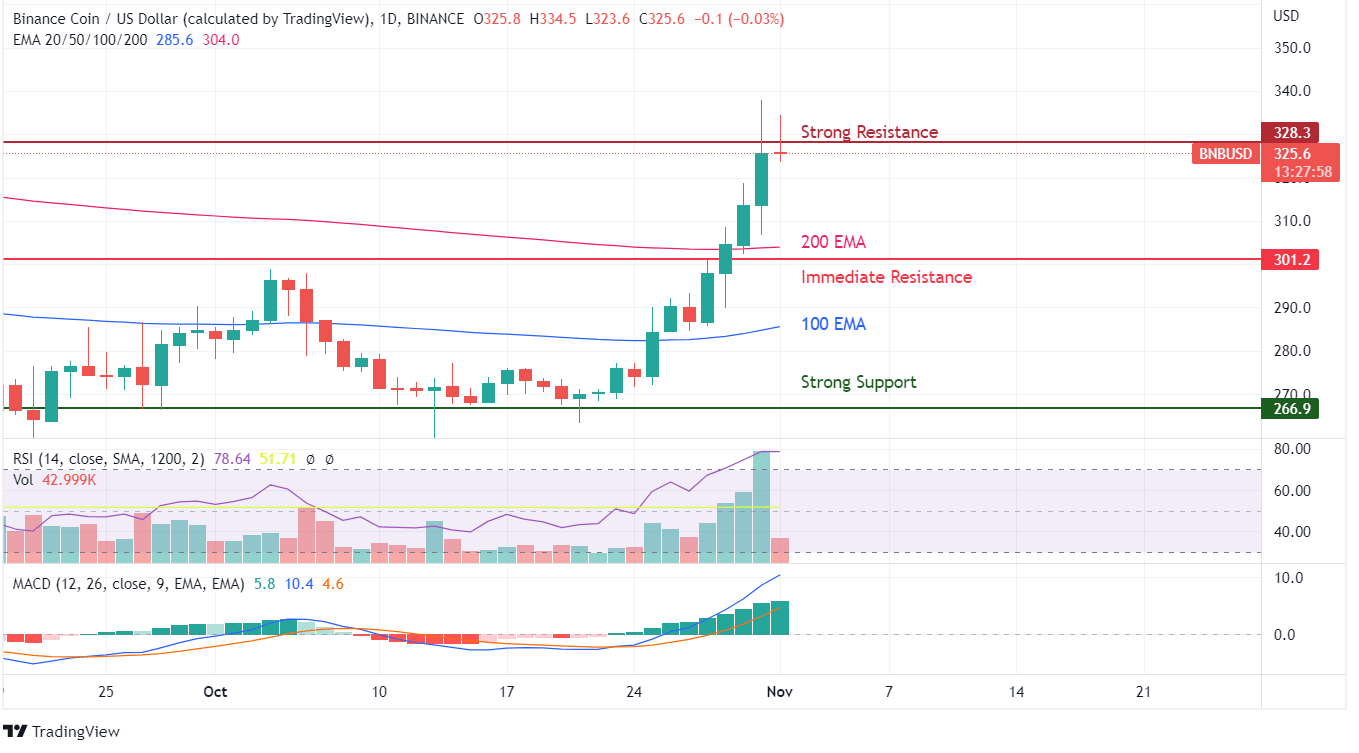

BNB has made a significant up movement in just one week, which closely resembles the previous price action, particularly with August. BNB failed to meet the selling pressure of the 200 EMA curve at the peak of August 2022 and succumbed to the profit-booking stance.

The resistance for the BNB token has re-emerged at the same levels as before, with the outlook moving towards $330. The previous resistance of $330 was aptly breached without any challenge. Another positive sign is the movement of 200 and 100 EMA towards the positive direction, indicating a pivot event under play.

The buying sentiment for BNB has reached an all-time high, with RSI showing a level of 78. At the same time, transaction volumes have reached a multi-folded level compared to the previous common volumes.

MACD during this duration has reached a strong positive axis with a bullish crossover showcasing no sign of stopping any time soon. Although the volumes and positive movement have taken a break on the first day of November, buyers are in no mood to let the current opportunity slip out of their hands.

BNB has closed the gap with its previous strong resistance. The price action from this pivot point of $330 showcases the potential for BNB to reach $450. The strong resistance from the previous swing lies at $464.

The significant gap will create further bullish sentiment for BNB buyers, but ideally, one should wait for some upside movement before making an entry at such a high value. BNB has already made a huge jump in the last four months. An uptrend can shift to profit booking if buyers are unaware they can get trapped for months to come.