BNB, the native cryptocurrency of the Binance exchange, is up 0.75% during Friday’s trading session to trade at $634. While the broader market shows uncertainty with Bitcoin struggling to hold $85,000, the BNB price stands strong with key reversal patterns and acclamation from major institutions. With Binance’s firm dominance in futures trading, the asset price shows potential for a major price rally.

Key Highlights:

- Since January 2024, the BNB price recovery has been resonating within the formation of a wedge pattern.

- The latest data reveals that Binance remains the undisputed leader in the crypto futures trading market, consistently outperforming exchanges such as OKX, Bitget, and Bybit.

- The coin price back above daily EMAs (20, 50, 100, and 200) indicates the restoring bullish sentiment in the market.

Binance’s Futures Trading Dominance Fuels BNB Growth

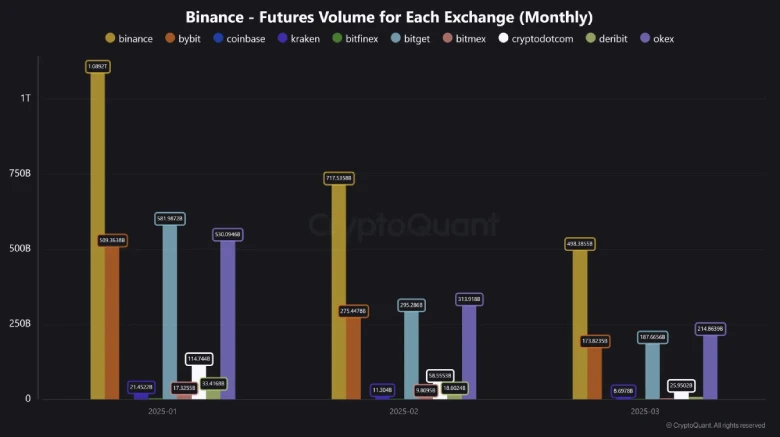

In a recent tweet, CryptoQuant’s analyst JAMaartun highlighted Binance’s dominance in the crypto futures trading market, outpacing its competitors by a wide margin in trading volume.

In January 2025, Binance recorded a staggering $1.08 trillion in trading volume across all futures pairs. This figure significantly overshadowed its competitors and solidified its position as the go-to platform for leveraged trading.

The trend persisted into February 2025, with Binance posting $717 billion in trading volume. While this marked a decline from the previous month, Binance still maintained a commanding lead.

As of March 2025, trading activity continues at a robust pace, with Binance already accumulating $498 billion—a number that is expected to rise as final figures are tallied.

As trading volume surges, demand for BNB— used for trading fee discounts, collateral in futures positions, and various ecosystem utilities — is expected to rise. The higher exchange activity should drive natural demand pressure in BNB, potentially driving its price higher.

Wedge Pattern Signals 30% Rally Ahead

In the last two weeks, the BNB price showcased a V-shaped recovery from $608 low to current trading value of $635, registering a 25% growth. An analysis of the daily chart revealed this upswing as a bull cycle with the formation of a rising wedge pattern.

Theoretically, the chart setup offers two converging trendlines which acts as dynamic resistance and support of consolidating price. Historical data shows a bullish reversal from the support trendline has carried a recovery rally ranging from 48%-148%.

If history repeats, the Binance price could surge another 30% to challenge the overhead trendline at $825.

However, until the wedge pattern is intact, the asset price will remain in a slow yet steady uptrend.

Also Read: 3 Reasons Why Ethereum Price May Reclaim $3,000 in April