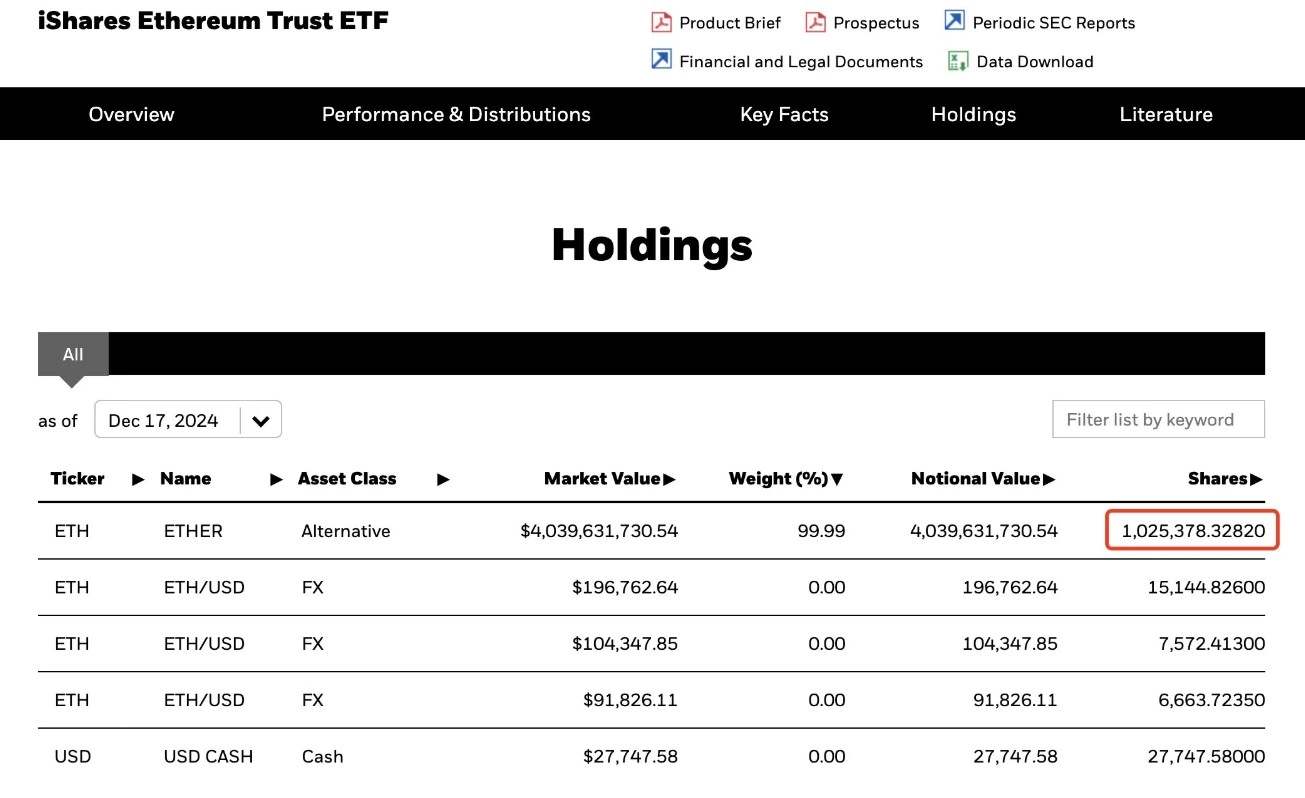

BlackRock’s iShares Ethereum Trust ETF has surpassed 1 million ETH in holdings marking a significant milestone for the company. The fund now holds, 1,025,378 ETH valued at approximately $4.04 billion. This move is going to solidify BlackRock’s hold in the Ethereum (ETH) market and it also shows the rising institutional interest in ETH.

Ethereum Approaching Critical Resistance Level

Meanwhile, technical indicators suggest that the ETH’s price is approaching a critical resistance at $4,100 mark as a key threshold. If the token manages to breakthrough this level, the token could rally substantially. According to the chart data shared by @ali_charts, a well-known crypto analyst, ETH’s price is trading within an ascending channel and approaching the Fibonacci retracement level of 1.0 at $4,867.95.

Technical Indicators Signal Bullish Momentum

According to the analyst, once the $4,100 mark is cleared, the $6,000 mark will be easy to hit. The price action aligns with historical patterns where breakouts from key resistance zones tend to trigger significant bullish moves.

The chart also highlights potential target above $6,000 including $7,751 and $9,882, indicating optimistic bullish outlook for ETH.

Institutional Backing Fuels

The combination of institutional accumulation and positive technical setup positions ETH for potentially explosive move. With BlackRock’s substantial holdings, various Ethereum Price Prediction and and growing investor interest, the community now will closely monitor ETH’s movements and charts to see if it can breakthrough the $4,100 barrier or not.

Also Read: XRP Price Prediction 2025, 2026, 2030, 2040 – 2050