Bitcoin (BTC), the world’s leading cryptocurrency, is predicted to reach a whopping price of $1 million per token by the year 2029. These predictions have been carried out by the research team of Bitwise. Ryan Rasmussen, the Head of Research at Bitwise posted this prediction on social media platform X.

Bonus Prediction: In 2029, Bitcoin will overtake the $18 trillion gold market & trade above $1 million per bitcoin.

That being said, if the U.S. announces it is buying 1 million bitcoins for a U.S. strategic bitcoin reserve, we could get to $1 million per bitcoin a lot faster. pic.twitter.com/gQTcvXENmg

— Ryan Rasmussen (@RasterlyRock) December 11, 2024

These predictions have been made by studying BTC’s historic four-year cycles and the predictions suggest that the cryptocurrency could also overtake gold’s $18 trillion market valuation and become the key asset in the global financial system.

The Rise of Bitcoin Through Four Year Cycles

The growth of BTC price has been divided into very distinct four year cycles where there have been sharp gains, followed by corrections. All the Bitcoin price predictions and data from Bitwise Asset Management highlight these trends, such as the monumental 5,537% return in 2013 or the significant drop of 75% in 2018. Even though there have been fluctuations, BTC has shown consistent growth during longer time frames.

The Strategic Bitcoin Reserve Theory

According to Rasmussen’s tweet, if the U.S. government announces the establishment of a strategic BTC reserve by purchasing 1 million Bitcoins, the move would create shockwaves through the market and would create a huge amount of demand and surge the price of the token. With this move, it could take less time for BTC to reach the seven-figure milestone for the token.

A Battle Between Bitcoin and Gold

Gold has been the go-to asset in case of economic uncertainty and currently gold has a market cap of approximately $18 trillion. According to the tweet by the head of research at Bitwise, BTC has the potential to surpass gold’s market cap due to its decentralized nature, fixed supply and growing adoption with in the institutions and investors.

If BTC’s market cap surpasses the market cap of gold, it could lead to increased adoption of the blockchain technology as shift in investor preference towards digital assets will be observed.

According to the report by Bitwise, the increase in the price of BTC seems imminent and the next decade could see BTC transition from a speculative investment to a globally accepted and recognized financial investment asset.

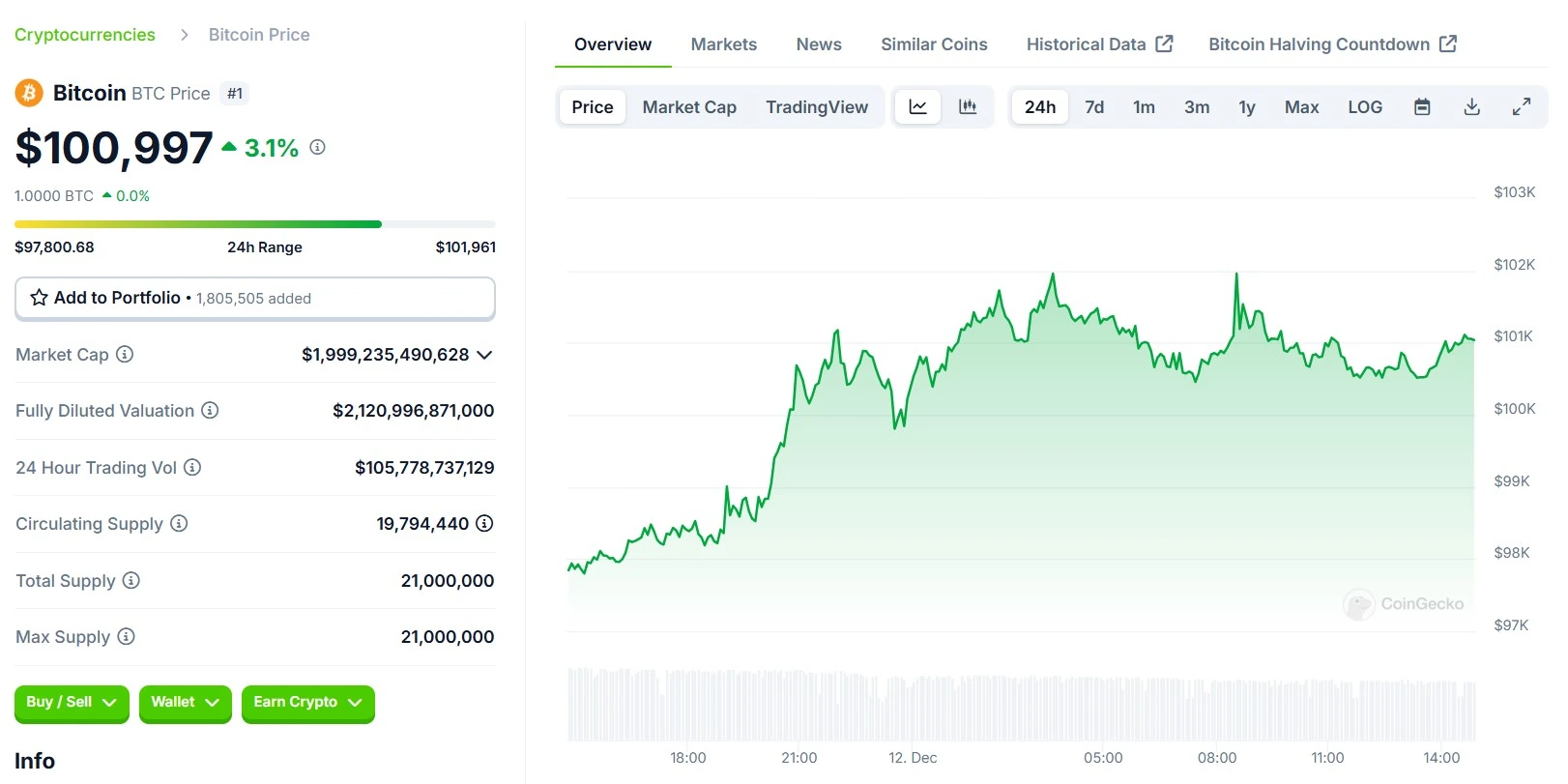

At press time, the price of BTC token stands at $100,997 with a surge of 3.1% in the last 24 hours.

Also Read: Google Releases Gemini 2.0 Flash; OpenAI ChatGPT Faces Outage