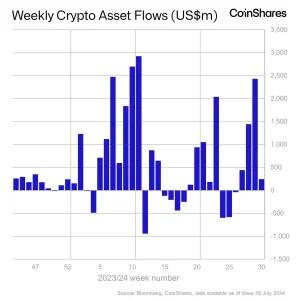

According to the latest CoinShares report, digital asset investment products saw relatively moderate capital inflows of $245 million last week, painting a mixed picture across various cryptocurrencies. Bitcoin continued attracting substantial investments, gaining $519 million in the week prior and accumulating $3.6 billion month-to-date alongside a record-setting $19 billion year-to-date.

Recent comments by Trump likely fueled robust interest. They presented Bitcoin as a possible strategic reserve asset alongside elevated likelihoods of a Federal Reserve rate cut in September 2024, renewing investor confidence and contributing to healthy inflows.

Ethereum witnessed considerable movement with the US launch of spot-based Ethereum exchange-traded funds, producing some of the most significant inflows since December 2020. Newly issued ETFs collected $2.2 billion, propelled by recent price gains and heightened weekly trading volumes peaking at $14.8 billion—the maximum since May of this year.

However, this positive sentiment was counterbalanced by substantial withdrawals from Grayscale’s pre-existing trust, resulting in a net outflow of $285 million. This outflow is associated with Grayscale’s new Mini Trust ETF being seeded with capital from its closed-end trust alongside ongoing investor redemptions, matching Bitcoin trust outflows seen during the January 2024 ETF introductions.

While inflows were mixed, total assets under management (AuM) rose to $99.1 billion, mainly due to recent price advances. ETF inflows are already at a record high this year, with $20.5 billion flowing into crypto funds during their best first quarter yet for attracting investment in digital assets. The latest ETF launches have had a significant market impact, with the surge in trading volumes—notably 542% for Ethereum ETPs.

Analyst’s Perspective

Given the split inflows, they point to a robust underlying interest in digital assets, more broadly Bitcoin and Ethereum, which is reflected by record levels of exchange volume this year. These strong inflows show that institutional investors have a lot of confidence in Bitcoin based on macroeconomic themes and its now strategic reserve status.

Meanwhile, this action on behalf of Ethereum ETFs underscores the high ceiling for growth, even if structural outflows across existing trusts somewhat offset it. As we move forward, the development of digital asset investment products such as ETFs will determine how these markets behave.

Analyst Anthony Pompliano says Bitcoin and Ether ETF work together, boosting the value of the crypto industry as a whole.

Investors should pay attention to regulatory changes, macroeconomic indicators, and the continued performance of ETFs that have recently hit the market to get an idea of future markets’ direction. In the future, these factors will determine how much of the digital asset investment inflows are sustainable and to what levels they can grow, but for now, Bitcoin is in the lead.