This past week, the volatility in cryptocurrency markets was intense and fueled primarily by macroeconomic changes, notably the Federal Reserve’s surprise interest rate cut. Bitcoin spearheaded upward movements, topping out at $63,800 before stabilizing above crucial technical indicators like the 50-day moving average. Now, new data from the U.S. Department of Labor reveals that unemployment claims for the week dropped to 218,000—the lowest since May—signaling a solid labor sector. In addition, requests for lasting goods in August continued to be stable, defying expectations of a decrease, and the second-quarter GDP stayed at 3%.

This information has reinforced investors’ assurance of the U.S. economy’s sturdiness. Risk appetite came back into the market, and Bitcoin’s price shot further up. The cryptocurrency was up more than 5.63 percent at $65,887 after hitting a record high of over $65,000 and standing second-best-performing U.S. equity year-to-date.

Bitcoin is up 3.31% in the last 24 hours, reaching $65,799 at the time of writing. In this regard, Arman Shaban, a TradingView analyst, predicted that Bitcoin’s short-term targets are $67,700 and $71,800. This BTC price prediction will all hinge upon the core Personal Consumption Expenditures price index for September, which would determine whether the Federal Reserve’s policy-making triggers a bull run or a downturn.

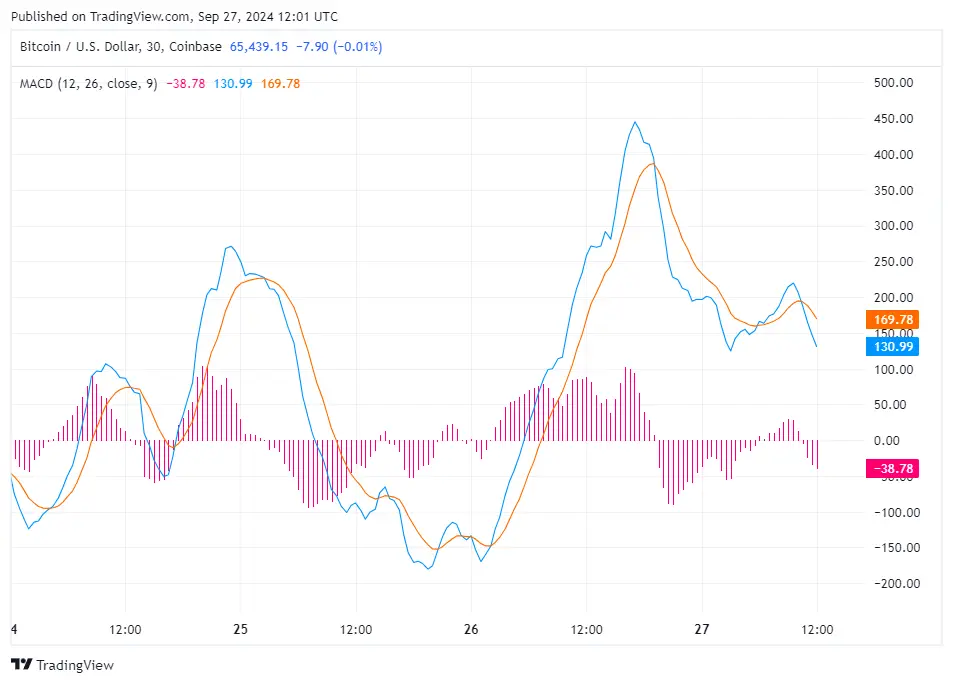

As per MACD analysis, in the last 30 minutes, Bitcoin’s buying pressure is slowing down, indicating that a price correction for the cryptocurrency is on the way. At the same time, trends can take a while to die down, and when assessed by the 4-hour movement of the MACD line, a bullish crossover is maintained. In the case a price consolidation is to occur, Bitcoin’s upward momentum has more possibilities of continuing than not.

The analyst is optimistic that Bitcoin could continue to rise towards $80,000 if inflation fear subsides. If PCE data exceeds the current expectation, inflation will run hot, meaning the Fed might tighten Bitcoin and other digital assets’ prices. In this case, the support level can come down to $60,000, while the resistance might be at the $62,000 level.