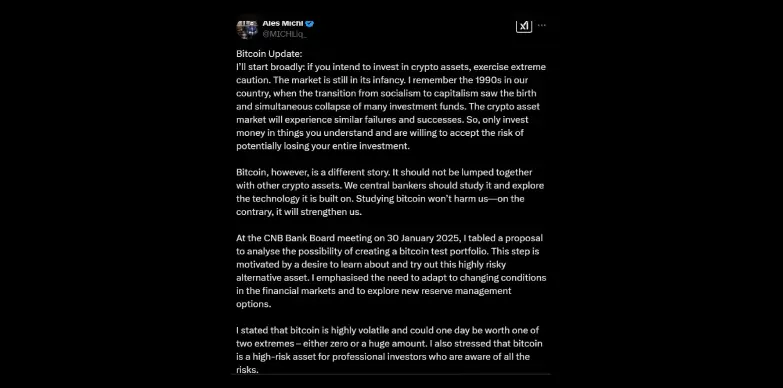

With the current volatility surrounding the crypto industry, the Governor of Czech National Bank (CNB) has called out for caution while investing in digital asset but on the contrary has proposed an analysis into the possibility of creating a Bitcoin (BTC) test portfolio.

This initiative was proposed at the CNB Bank Board meeting held on January 30, 2025. This move simply indicates the confidence in the potential of BTC and it also implies that there is a high possibility of the token being integrated into the bank’s reserve management strategy.

The Governor has asked the investors to be extra cautious while investing in the crypto market and he draws parallels between the unstable investment fund environment during the transition from socialism to capitalism in the 1990s. “Only invest money in things you understand and are willing to accept the risk of potentially losing your entire investment.” the Governor advised highlighting the speculative nature of the crypto assets and the industry.

Bitcoin is a Different Story

However, Bitcoin, according to the Governor demands a separate examination. According to the Governor, the bankers should study Bitcoin and understand its technology so that they can strengthen themselves and their banking sector in the emerging financial markets and leverage the capabilities of BTC in their favor. All of this comes from the fact that Bitcoin has a potential to act as a hedge against inflation and act as a store of value.

The CNB Bank Board has approved the proposal to analyze and study options for investing in additional classes which also includes BTC. The studies and analysis carried out will inform the Bank Board’s decision on how to proceed, with no changes to be implemented until a final decision is reached. This approach again reflects the risk associated with Bitcoin, which the Governor acknowledged as being highly volatile and subject to extreme price fluctuation.

Future Outlook

The proposal has already been accepted but if it gets implemented, the creation of Bitcoin test portfolio would represent a forward thinking approach in reserve management. This move could give rise to new diversification and create a hedge against economic uncertainties. However, this move by CNB indicates the importance of adapting to changing financial market conditions while remaining aware of the risks involved.

Also Read: Binance Alpha Lists $BROCCOLI Memecoins, Token Prices Surge