Sustainability is no longer a meaningless moniker to sell items but a lifestyle that all industries need to adopt to save the planet. So, it is not surprising that the financial ecosystem is slowly opening up to the idea of an eco-friendly alternative to digital assets. No doubt, cryptocurrencies possess many advantages, however, the biggest drawback is its effect on the environment.

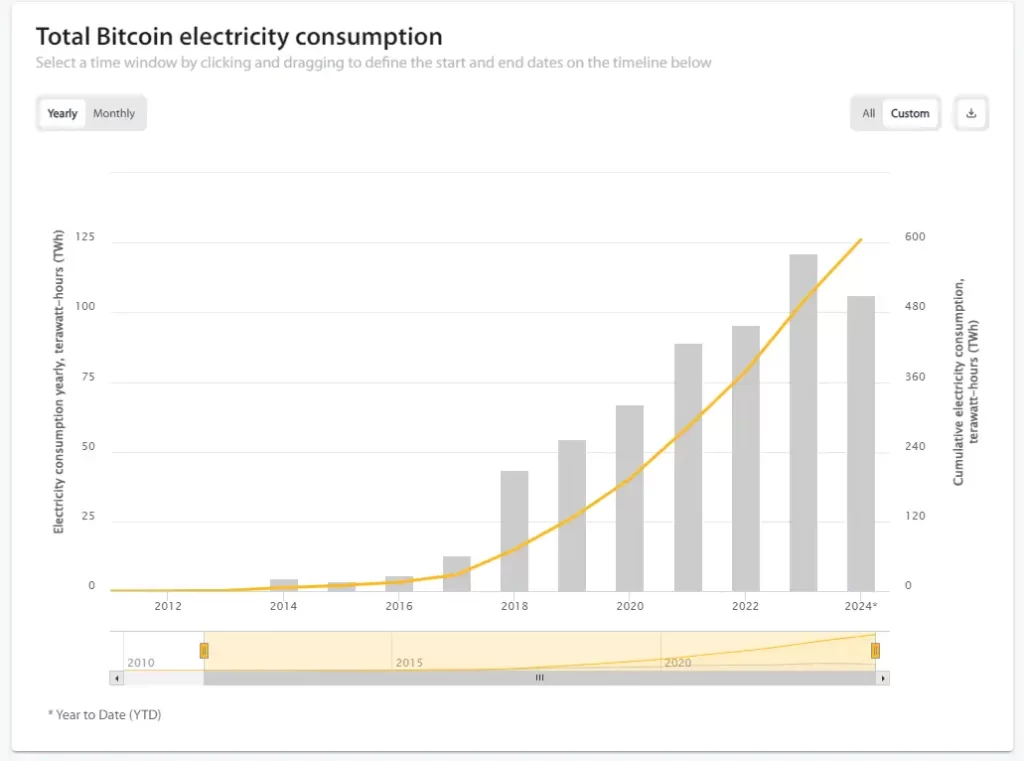

According to the Cambridge Blockchain Network Sustainability Index, 62% of electricity consumption used in Bitcoin mining came from non-renewable sources like fossil fuels in 2022. The most significant contributors to electricity are coal-generated power plants. From 2012 to 2024, the annualized consumption for mining Bitcoin stands at 156TWh. To put things into perspective, it is equivalent to the power used in 14 million homes in the U.S. in a year.

Carbon Credits and Sustainable Bitcoin

In December of 2023, 7RCC, an alternative investment manager, applied for an ESG-conscious spot Bitcoin ETF. The 7RCC Bitcoin and Carbon Credit ETF is going to be 80% Bitcoin and have 20% carbon credit futures. The idea for this Bitcoin ETF is centered around solving the adverse effects of Bitcoin mining by marrying digital assets with clean and green investment options. In the future, the carbon credit futures are likely to be paired with projects such as E.U. ETFs, California Carbon Allowance, and Regional Greenhouse Initiatives to seal its green seal of approval. In addition, the 7RCC Bitcoin ETF will use Gemini Trust Company LLC as its custodian for Bitcoin, a leading crypto exchange that has been around for years.

Market Potential and SEC Approval

In January 2024, the SEC approved 11 spot Bitcoin ETFs but seemed to need to believe in the value proposition of the asset. Gary Gensler, the chairman of SEC, said the committee was deeply skeptical about cryptocurrencies and warned that its approval did not mean it gave a nod to Bitcoins. He continued to alert investors about crypto and investment products tied to crypto as “risks associated.” Other commissioners, such as Caroline Crenshaw, clearly showed their disagreement with the SEC’s decision, saying the SEC made a colossal mistake.

As of now, the SEC’s approval of eco-friendly Bitcoin ETFs is far from certain. However, the approval for sustainable Bitcoin might see fewer hurdles to overcome due to its relation with ESG concerns. The ETF model of 80% Bitcoin and 20% carbon credit can whet investors’ appetites as the product is packaged as a more responsible and legitimate option in the crypto ecosystem.

That said, Gary Gensler might take a solid look at the product as a legitimate option due to the hard-to-fake characteristics associated with it. However, a sustainable Bitcoin ETF would still have to go through regulatory scrutiny and fall in line with all compliance requirements to get a green light. Even with the risk-reduction component of these, ETFs with tokenized carbon credits cannot get a nod of approval if they fail to prove that their security measures are robust against market manipulation as well as fraud.

There is another challenge the sustainable Bitcoin ETFs would need to overcome in order to have value in the market, despite a ‘yes’ from the SEC. As of September 5, the total outflow of Bitcoin ETFs has surpassed the $1 billion mark after seven consecutive days of outflow. This is a signal of waning interest alongside market volatility and broad skepticism for Bitcoin. Therefore, in an already saturated ETF market, the merit of another Bitcoin ETF (although sustainable) to bring in profits to asset managers is questionable.

Towards A Greener and Cleaner Crypto

An essential element of growth here is the sustainability label. If a sustainable Bitcoin ETF does launch, it might actually draw more attention from ESG investors who are not yet keen on investing in Bitcoin due to the environmental impact. By making Bitcoin greener, carbon credits may be a solution to alleviating the current stress ETFs are experiencing in the market. Despite short-term outflows, there is a growing trend towards green investments, which can help bring up the price of Bitcoin as an asset and an ETF.

Bitcoin has a long way to go; while it is benefiting from the recent SEC approval of 11 ETFs, we still need a large piece of the market due to criticism Bitcoin continues to face from groups like Greenpeace USA and lawmakers like Senator Elizabeth Warren. By adopting an eco-friendly Bitcoin, climate criticism can be nipped in the bud. As Bitcoin sees increasing interest from either climate-conscious investors or investments coming in as part of CSR initiatives, it would be a win-win for both investors, the crypto industry, and once might hope against all odds, the SEC might come around.