Bitcoin (BTC), the leading cryptocurrency, has once again reached the $100,000 mark, the third time in December. However, the question here remains about whether it can maintain this historic price point or not.

First and Second Surges Above $100K

Bitcoin first crossed the $100,000 mark on December 3, due to institutional buying and optimism surrounding the upcoming ETF approvals. This rally was short lived as people started pulling out the money causing the price of the token to drop below $95,000.

The second time the token hit the $100,000 mark was on December 8, which was due to increased hash rate and declining exchange reserves. During the second rally, the token withheld the $100,000 mark for a longer period of time but faced resistance at $102,500 and later dipped down to $98,000.

The Third Breakthrough

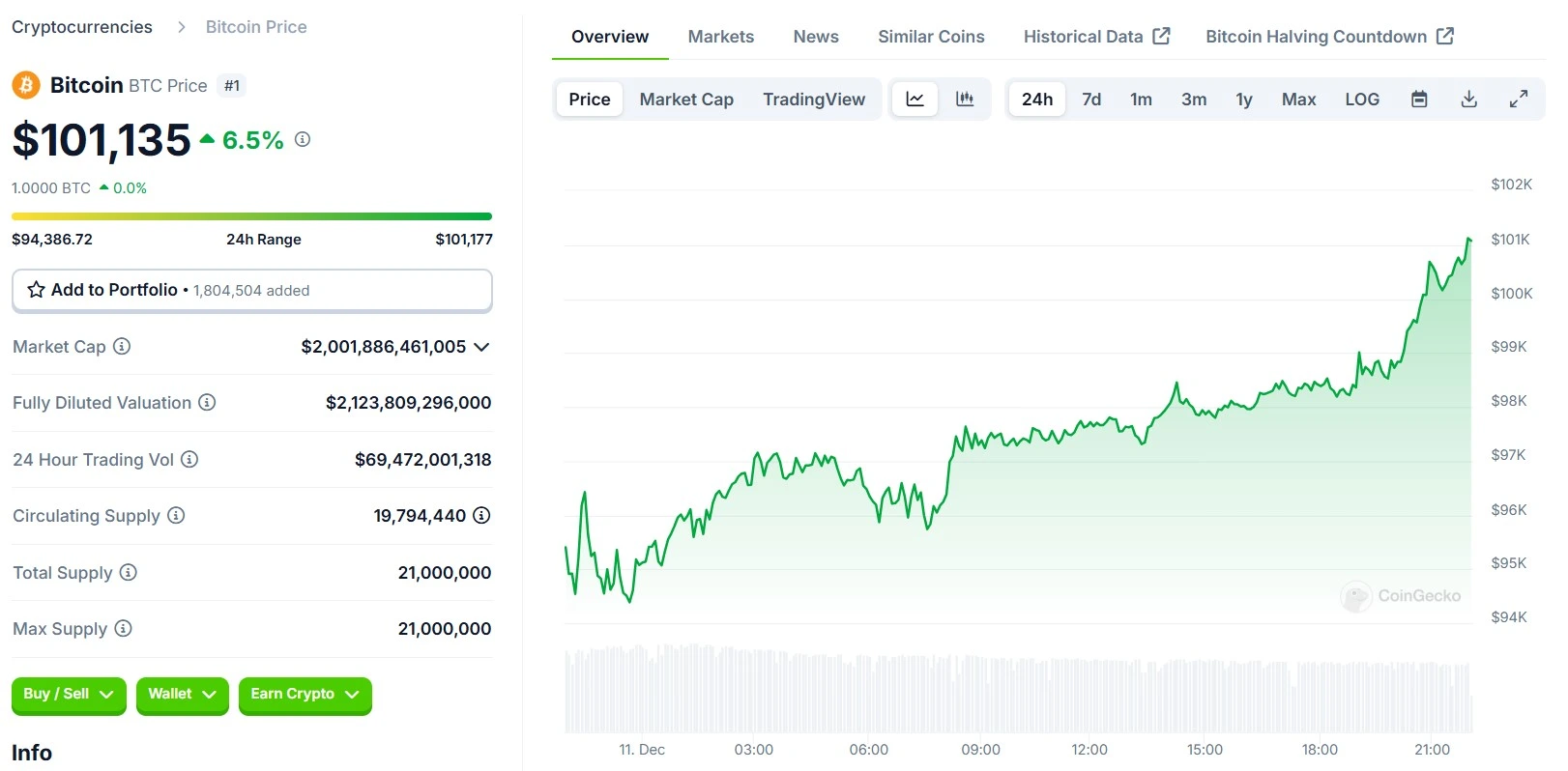

Today, December 11, Bitcoin crossed $100,000 yet again. This mark has proven to be a key technical resistance level, with heavy trading activity concentrated around this price.

The reason for this rally is macroeconomic conditions and increased interest from sovereign wealth funds. According to various analysts, the Bitcoin token might face resistance at $103,000.

Will Bitcoin Hold Above $100K?

Analysts believe that there are chances that the token can sustain its price above $100,000 and they are now eyeing a potential Bitcoin price prediction of $110,000. This rally is due to increased adoption by institutional investors. Additionally, technical indicators like the Relative Strength Index (RSI) remains neutral, leaving room for further developments.

On the other hand, due to macroeconomic uncertainties, there could be push back below $100,000. If BTC fails to hold above the $100,000 mark, key support level would be at $95,000. A break below these levels could signal a deeper correction.

At press time, the Bitcoin price stands at $101,135 with a surge of 6.5% in a the last 24 hours.

Also Read: Shiba Inu Bounces Back After 11% Dip: Investors Resilience Pays Off