Bitcoin has been doing quite well for itself after a tumultuous past week. On Monday, Bitcoin, priced at $61,744, broke its ongoing trend and started its move upwards. At press time, Bitcoin is priced at $67,549.74, a +8.88% increase in price over just 24 hours. The market sentiment around Bitcoin further escalated in the wake of Tesla, the electric vehicle giant, moving its entire Bitcoin stash to an unknown wallet.

Tesla transferred the whole Bitcoin inventory, which is valued at over $765 million. The company made a groundbreaking move by accepting payments in Bitcoin for purchasing its vehicle back in 2021. However, Tesla subsequently suspended vehicle purchases using Bitcoin by citing concerns regarding Bitcoin mining practices and transactions, particularly those dependent on fossil fuels such as coal. The company later clarified that it was not selling its stake in Bitcoin despite the suspension of accepting Bitcoin as a payment option.

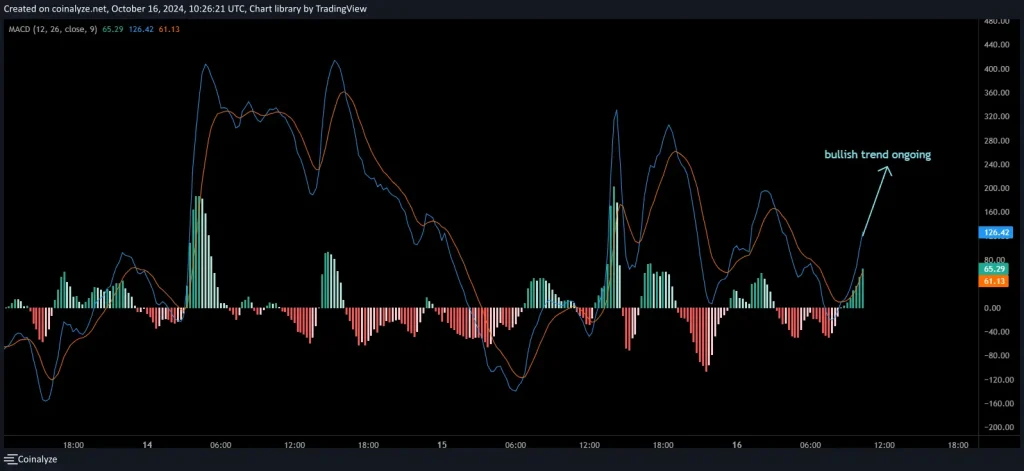

The cryptocurrency world is dynamic; therefore, even as Bitcoin’s price has almost reached its ATH of a month, the real question is whether Bitcoin can sustain this resistance level or will fall back down as it did a couple of weeks ago. This article will use the MACD analysis to see whether Bitcoin can keep its bullish momentum going.

Bitcoin Technical Analysis

The MACD chart indicates a bullish trend as the MACD line crosses above the signal line. It is further supported by green histogram bars, which show increasing momentum. Based on Bitcoin’s price predictions and the ongoing price action, there is a growing buying pressure in the market, which could lead to further upward movement. Currently, the key psychological level is around 100 (as round numbers often act as a significant point for traders).

For resistance, it is important to observe the area around 126, where the MACD had previously peaked. This indicates potential resistance due to past price activity. The support level appears near 61, where the MACD line last took a turn upwards, suggesting that buyers may re-enter the market if prices fall back shortly.