Over the past week, Bitcoin (BTC), the leading cryptocurrency, saw a significant price dip. According to the sources, the price of the token dropped by 5.6%. This reason for this dip is partly being attributed to the holiday season as the trading volumes have reduced.

Low trading activities usually lead to an environment where the token prices becomes volatile and fluctuate. These fluctuations do not usually affect long-term investors but short-term traders are currently feeling the strain.

Bitcoin Breaks Below the Trendline

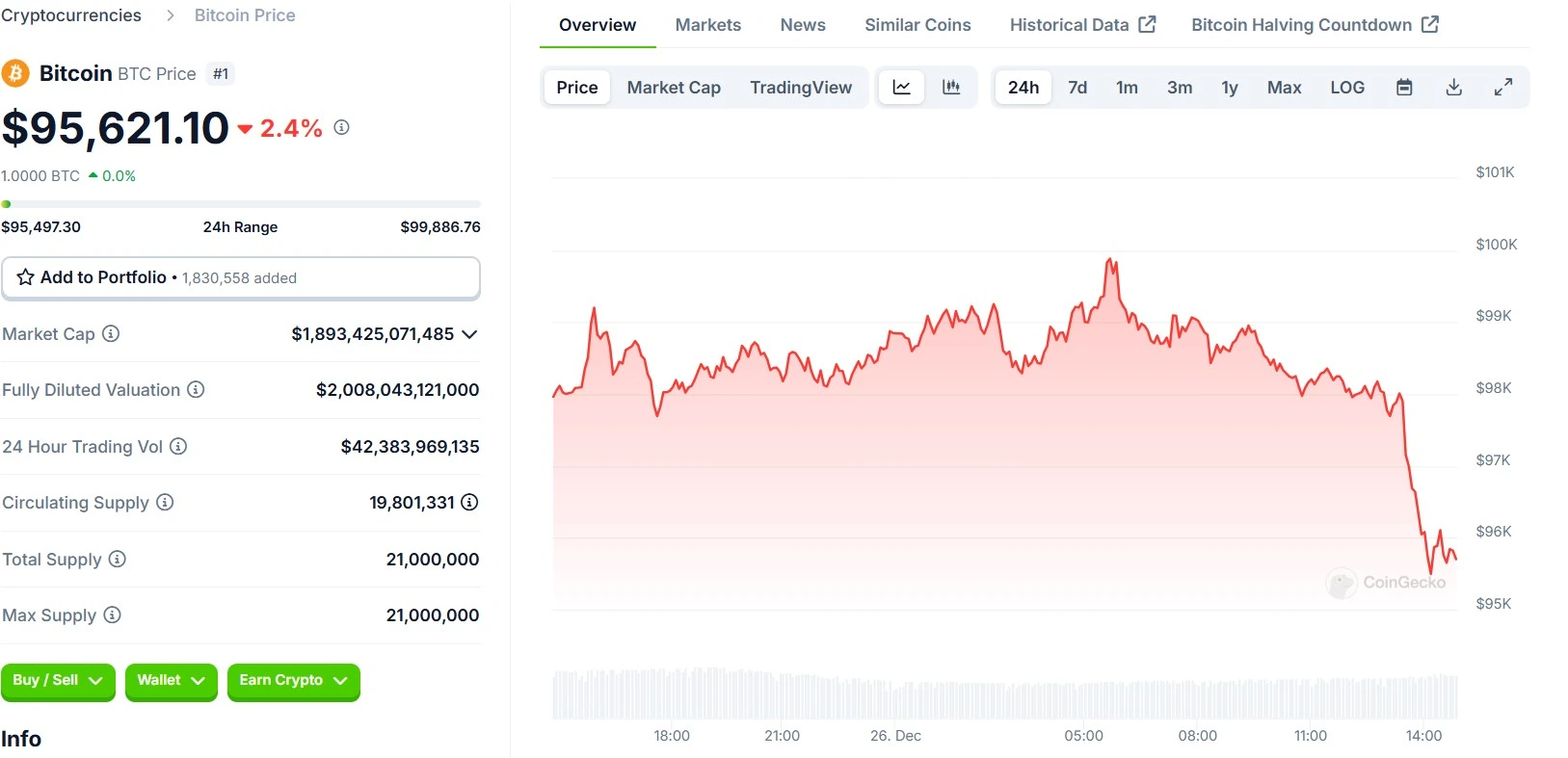

According to a well-known crypto influencer and analyst on X @MMCrypto, the chart below shows Bitcoin breaking below an upward trendline, signaling a potential bearish reversal. While a target of $85,000 remains plausible, analyst suggest refraining from opening new long positions until a clear breakout confirms another leg up.

BTC’s current price $95,621.10 with a dip of 2.1% in the last 24 hours reflects its struggle to regain momentum, and hence remains below the critical resistance levels.

Analysts Remain Optimistic

Lower activity has lead to these price dips in the cryptocurrency market. However, analysts still remain optimistic for BTC’s future in the coming year. For instance, Bitwise made Bitcoin price predictions, where according to them the price for BTC could reach $200,000 by 2025 and there is a possibility that it could also hit the $500,000 mark .

Similarly VanEck also predicted that the price for the token could climb up to $180,000. All of this seems like a high possibility under Trump administration and his idea of establishing strategic BTC reserve.

With current market conditions, the investors will remain cautious and it is recommended that they avoid making any impulsive decisions, rather rely on a long-term strategy that will help them get through these difficult times.

Also Read: Bitcoin Cash Price Prediction : Insights for 2025 – 2030