During Tuesday’s U.S. trading session, the crypto market witnessed a bullish rebound after days of selling pressure. However, this uptick could be a short relief rally as President Donald Trump’s expanding tariff policies could continue to pressurize cryptocurrencies. While it’s early to expect a bottom formation for the majority of assets, the Avalanche price could witness investors’ attention amid VanEck’s registration of AVAX ETF in Delaware.

Key Highlights:

- VanEck registered an AVAX ETF in Delaware, suggesting institutional interest in Avalanche.

- Since mid-December 2024, a downsloping trendline has guided Avalanche price with dynamic resistance.

- A bearish breakdown from $17.3 set the AVAC price for another 30% dip.

VanEck Registers Avalanche ETF in Delaware

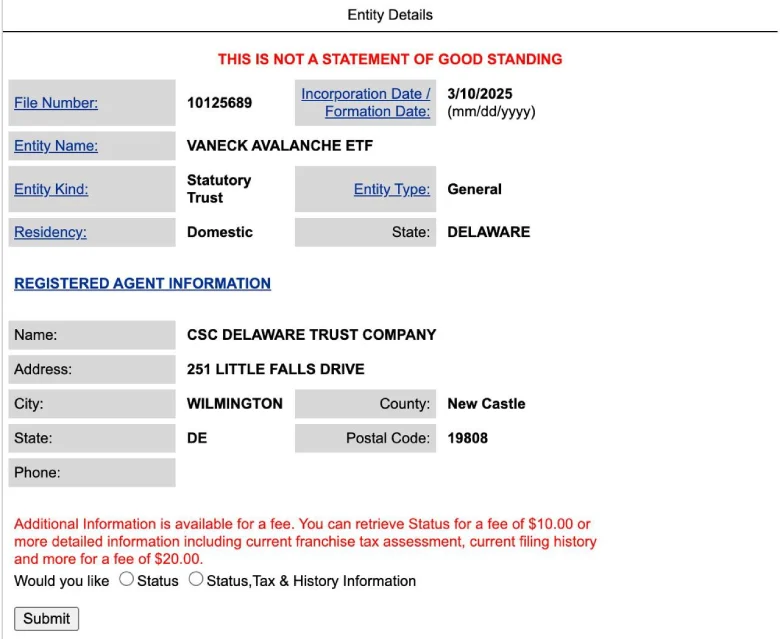

On March 11th, the asset management firm VanEck registered an Avalanche (AVAX) ETF in Delaware. The registration details, revealed in a document filed under the VanEck Avalanche ETF, show the entity has been incorporated as a statutory trust with a domestic residency in Delaware. The document also names CSC Delaware Trust Company as the registered agent, based in Wilmington.

While this registration does not confirm an immediate ETF launch, it suggests that VanEck is taking steps toward offering a regulated investment vehicle for Avalanche. As the new presidency of Donald Trump shows support for crypto adoption and ease in regularity hurdles, an asset like Avalanche could enter the ETF market.

Avalanche Price Fake Breakdown Hints Recovery Potential

In the last three months, the Avalanche price experienced a high-momentum downtrend from $56.7 to $17.1 current trading value, registering a 69% fall. The daily chart analysis shows a downsloping trendline connecting the lower high formation in AVAX, indicating a sell-the-bounce sentiment in the market.

On March 10th, the coin price breached another horizontal support of $17.3, paving the seller’s way to drive another 32% decline and hit $12.

However, with VanEck’s registration for AVAX ETF and broader market uptick, the Avalanche bounced +8% today. If the uptick closes above $17.3 floor, the buyers could attempt to challenge the overhead trendline and regain the recovery momentum.

Also Read: CBOE Seeks SEC Approval for Staking in Fidelity Ethereum ETF