Bitcoin is attracting the interest of investors and traders globally, sparking opinions on its short-term outlook in the market. While some experts caution about a decline to $40K, hinting at a downturn, others point to the PI Cycle Top Indicators’ track record of accurately foreseeing bull market highs, suggesting an impending significant price shift. Given the uncertainty, the looming question remains: Which scenario will play out?

Bitcoin Dropping to $40K

More and more analysts are now warning that the cryptocurrency is on the cusp of a fall, one that might very well draw it to $40,000. We were, therefore, not surprised to find that general sentiment around crypto in the wider financial world has led some observers and journalists to suggest doom and gloom for 2019.

One of the reasons for this prediction is due to a reduction in the price at which Bitcoin settles and continued rise in volatility. With interest rates, tighter monetary policy, and regulatory issues, there are questions about the stability of Bitcoin. David Mass, co-founder of Web3 infrastructure provider Hydrogen Labs, mentioned Bitcoin might crash to $40K on TheStreet Roundtable. His apprehension is geared towards September rate cuts and November elections.

In the past, Bitcoin has seen massive price drops following a brief period of surges, leading some experts to believe that the current market conditions might be heading in a similar direction.

The Bullish Case: PI Cycle Top Indicator Predicts $96K

On the other hand, the PI Cycle Top Indicator is more optimistic and provides grounds to expect that Bitcoin is standing on the threshold of a significant upsurge. The abovementioned forecasting tool, widely known for its accuracy in detecting the markets’ peaks, currently signals the factors that contribute to the price increase. The PI Cycle Top Indicator measures two moving averages: 111-day and 350-day.

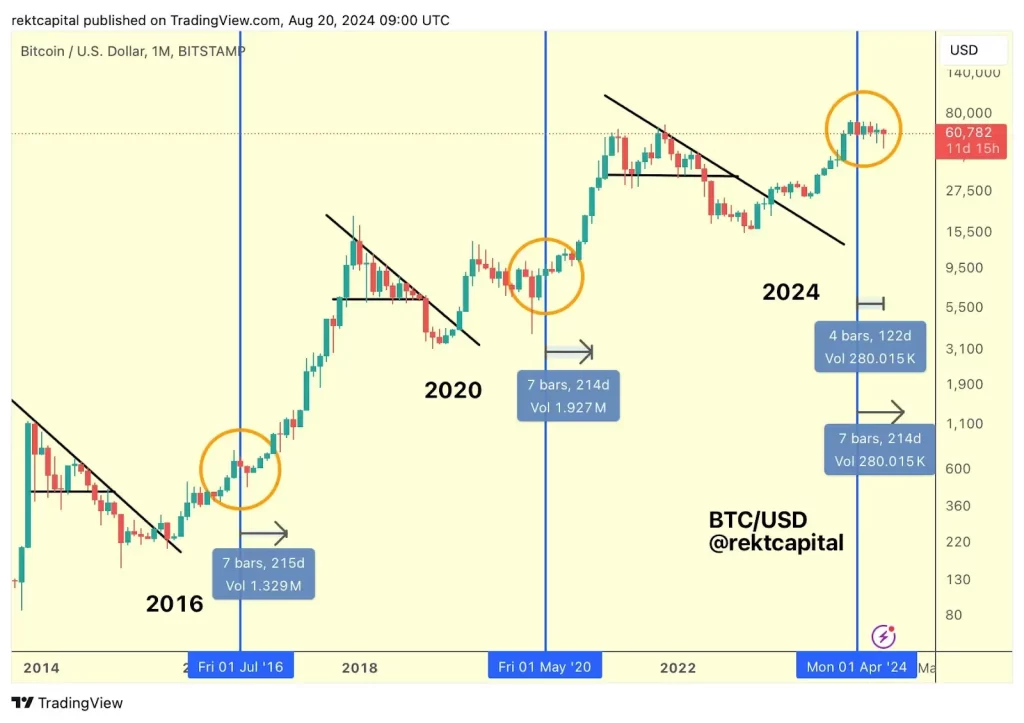

Traditionally, their convergence signals that the bull market has peaked and the bear market might have begun. Nonetheless, it is hard to determine whether these moving averages are diverging or converging since this ambiguity indicates that the market is not approaching the peak yet. The crypto analyst, who is known under Rekt Capital’s name, in his turn, noted that BTC prediction could go up to the $63,900 level and might instead claim further upsides.

Weighing the Two Scenarios

The cryptocurrency market is at a crossroads, with analysts divided between opinions stating that the drop to $40K could still be in front of us and others suggesting that significant returns might unfold, leading towards another bullish wave. A surge to $96K might be a tall order, given Bitcoin has traded anywhere between $49 -$69K over the past thirty days. Starting its trading range around $59K in this period, reaching the run of 96k now seems deceptive.

What are Bitcoin’s ceiling and floor?

At press time, Bitcoin was trading at $60,757.63. If this current upward move continues, we could be looking at $75K as a possible top in the not-too-distant future. Its mean price in 30 days has been $59000, and it could witness a fresh low of around $45000. It also reflects the consideration that some hyper-bearish forecasts of $40,000 would bring to the market is possible pressure. A sub-$45,000 dip would likely represent market instability and investor hesitancy but still be on par with where Bitcoin has moved over the last week or so.