XRP, the native cryptocurrency of global payment company Ripple, experienced a sharp +9% surge during Tuesday’s market session, to trade at $2.2. This uptick followed a broader market relief rally as trade tension eased between the United States and Canada. Amid the renewed demand pressure, the Ripple crypto price shows higher potential for a rebound as another prominent asset management seeks its launch spot XRP ETF.

Key Highlights:

- Franklin Templeton filed for an XRP ETF, joining Bitwise, 21Shares, Grayscale, and WisdomTree in the race.

- A bullish divergence in the daily Relative Strength Index (RSI) as it seeks support at $the 2 floors, reinforces the potential for a bullish reversal.

- The XRP price sustainability above 50% Fibonacci retracement level indicates a healthy correction for buyers to revive bullish momentum.

Franklin Templeton Joins the XRP ETF Race

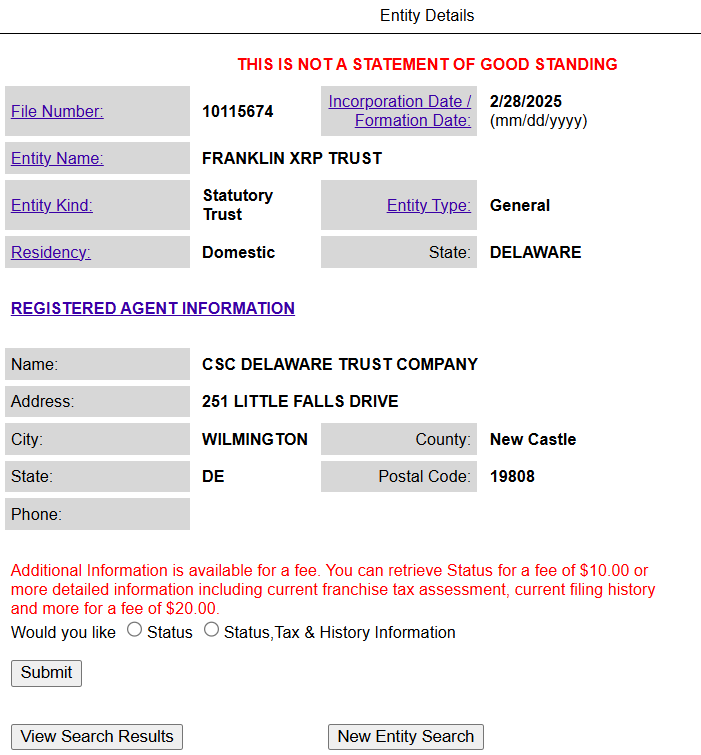

Franklin XRP Trust has officially filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) to launch an XRP exchange-traded fund (ETF), according to regulatory reports on Tuesday.

This move positioned Franklin Templeton among the growing list of asset managers competing to bring the first XRP ETF to the market, joining Bitwise, 21Shares, Canary Capital, Grayscale, and WisdomTree in the race. The proposed Franklin XRP Trust plans to list and trade on the CBOE BZX Exchange, offering investors regulated exposure to XRP.

The ETF will be structured to offer shares at net asset value (NAV), with only authorized participants having the ability to create or redeem shares. Pricing will be determined using the CME CF XRP-Dollar Reference Rate, ensuring transparency in valuation.

If approved, this ETF would boost XRP adoption and provide institutional investors with a structured and regulated way to gain exposure to this asset.

Multiple Support Sets XRP Price For 25% Rebound

An analysis of XRP’s daily chart shows its prevailing correction has shifted sideways above the horizontal support of $2. The aforementioned support coinciding close with the 200-day EMA slope and 50% retracement level indicate a strong accumulation zone for buyers.

During Tuesday’s U.S. trading session, the XRP price jumped +9% to trade at $2.2, while its market cap surged to $127.5 Billion. This uptick triggers a higher low formation in the momentum indicator RSI reflecting the surge in demand pressure at this bottom.

The bullish reversal could push the asset 24% up to challenge a downsloping resistance trendline near $2.75. A potential breakout from this resistance will signal the continuing recovery trend.

On the contrary, if a broader market correction forces a breakdown below the $2 floor, the bullish thesis will get invalidated.

Also Read: CBOE Seeks SEC Approval for Staking in Fidelity Ethereum ETF