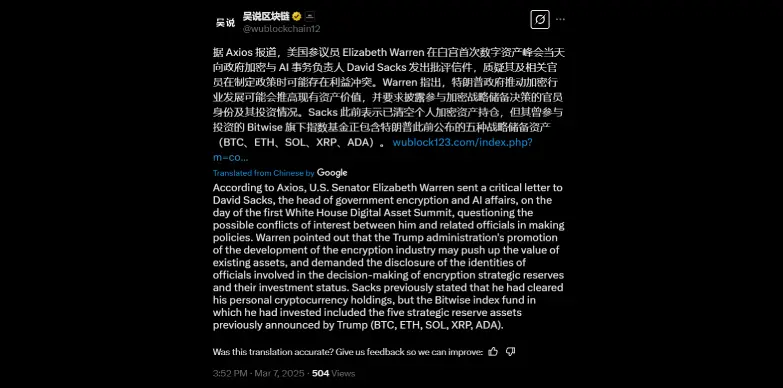

Senator Elizabeth Warren has raised concerns about potential conflicts of interest involving David Sacks, the head of government encryption and AI affairs, particularly in relation to cryptocurrency policies, according to Axios and Wu Blockchain. This comes in light of the first White House Digital Asset Summit and the Trump administration’s focus on developing the crypto industry.

Warren Raises Conflict of Interest Concerns

Elizabeth Warren’s concerns stems from the fact that there is a possibility that policies promoting the encryption industry could increase the value of existing digital assets. Moreover, Warren has has also expressed her concern that with such situation, officials in this space might benefit their personal investments or those of their associates.

In her letter, Elizabeth Warren demanded transparency regarding the identities and investment statuses of the officials involved in decision-making related to crypto strategic reserves.

She stressed that people and organizations must be held responsible for the actions in the quickly changing world of digital assets, because conflicts can damage public trust and the integrity of regulation.

Sacks’ Crypto Investment Under Scrutiny

Sacks has publicly stated that he sold all his personal cryptocurrency holdings on January 22 to avoid any potential conflicts once he took up the responsibility as AI and Crypto Czar.

However, scrutiny remains over his investment in a Bitwise index fund, which includes five strategic reserve assets previously announced by the Trump administration: Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and Cardano (ADA). This connection raises questions about whether Sack’s past investment could influence his current policy decisions.

Conflicting Ideologies

Earlier this year, Sacks commented on Trump’s launch of memecoins, asserting that he did not perceive it as conflict of interest. Nevertheless, Warren and Representative Jacob Auchinloss have voiced concerns that Trump’s token may pose risks to consumers and invite foreign influence, further complicating the already complex relationship between politics and cryptocurrency regulation.

As the digital asset landscape continues to evolve, Warren’s call for transparency may set a standard for future regulatory discussions.

Also Read : DWF Labs Deposits 3M FET Tokens Worth $1.82M Into Bitget