On March 7th, Thursday, the Solana price showed a neutral to bearish stance as the broader market fell with Bitcoin below $90,000k. The intact selling pressure limits the recovery potential for major altcoins and hints potential for further downfall. However, the latest onchain data on Solana’s total addresses signals a growing network which could eventually attract demand pressure for SOL.

Key Highlights:

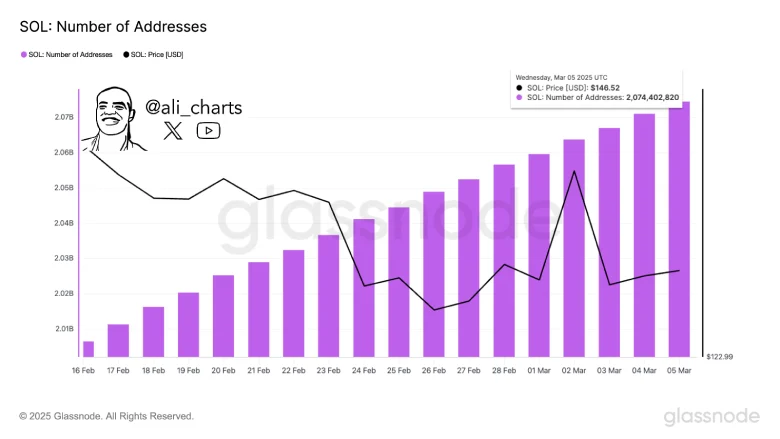

- The total number of Solana addresses has reached 2.07 billion, signaling increasing adoption.

- The Solana price correction could dive another 15% before retesting a major support level of $120.

- A recent death crossover between 50- and 200-day EMA could raise the market selling pressure for an extended correction trend/

SOL’s Growing Network Strengthens Long-Term Prospects

The layer-1 cryptocurrency Solana (SOL) has reached a groundbreaking milestone as the total number of addresses on the network has hit an all-time high of 2.07 billion, according to data shared by crypto analyst Ali. This surge highlights the increasing adoption and sustained growth of Solana’s ecosystem despite market fluctuations.

The below chart illustrates a steady increase in Solana addresses, with a notable rise in February and early March. While SOL’s price has experienced volatility, the network’s expanding user base signals strong fundamentals and continued investor confidence.

Solana Price Correction Deepens — Key Levels to Watch

In the last four days, the Solana price has plunged from $184.5 to $143m current trading value, registering a loss of 20.6%. This reversal marks another lower-high formation in the daily chart, indicating the market sentiment continues to follow a sell-the-bounce sentiment.

With the bearish momentum persisting, the SOL price is likely to plunge 17% down to retest the long-standing support of $120. This horizontal level stands as a crucial pivot point for crypto buyers as historical data displays a post-reversal rally, gaining a 60-120% surge.

If the support holds, the Solana price could shift downwards to sideways, recuperating the bullish momentum for the next leap.

On the contrary, a breakdown below the $120 floor could drive a major dip for this asset.

Also Read: World Liberty Financial Expands Token Reserve with SUI – What’s Next?